Business

Editorial. Pressure tactics

Since April 8, when President Trump slapped his reciprocal tariffs on 57 countries with a 90-day deadline for them to take effect, his administration has gone overboard in ramping up the pressure on India. The gambit here is crudely simple — to force India to ink a deal in these 90 days, before July 8, in order to escape the 26 per cent tariffs that are expected to kick in after that. The same trick is being played out with the rest of the world as well, forcing quite a few countries to line up for talks with the US. In India’s case, Trump and his colleagues have cynically generated a lot of confusion. India has maintained a studied silence in the face of zero tariff claims. Its reticence was perhaps aimed at ensuring that the talks proceeded in good faith. But US’ actions have marred the process. Trump has proposed a ‘big beautiful Bill’ that may ‘tax’ 5 per cent of billion NRI remittance outflows. India should be circumspect in the face of pressure, without allowing the US to set the pace in the talks. A bad deal cobbled in haste is far worse than none at all. Meanwhile, India sent out another sharp message that it will look out for its interests. In a throwback to Trump 1.0, India has proposed retaliatory action on US’ tariffs on steel and aluminium. However, it needs to work out a plan with respect to other areas as well. At the outset, it should be clear that the US’ interests in India go beyond trade per se to persuading India to alter its regulatory systems with respect to GM food, e-commerce, big tech, pharma and other high tech sectors. It is also keen on access to India’s food (maize and soyabean) and dairy sector, besides selling defence equipment and oil. India has enough in its toolkit to squeeze a deal that does not hurt its interests. A levy on e-commerce monopolies, a cap on royalty payments, applying data localisation rules and compulsory licensing of patented drugs can be used to ward off an adverse outcome.

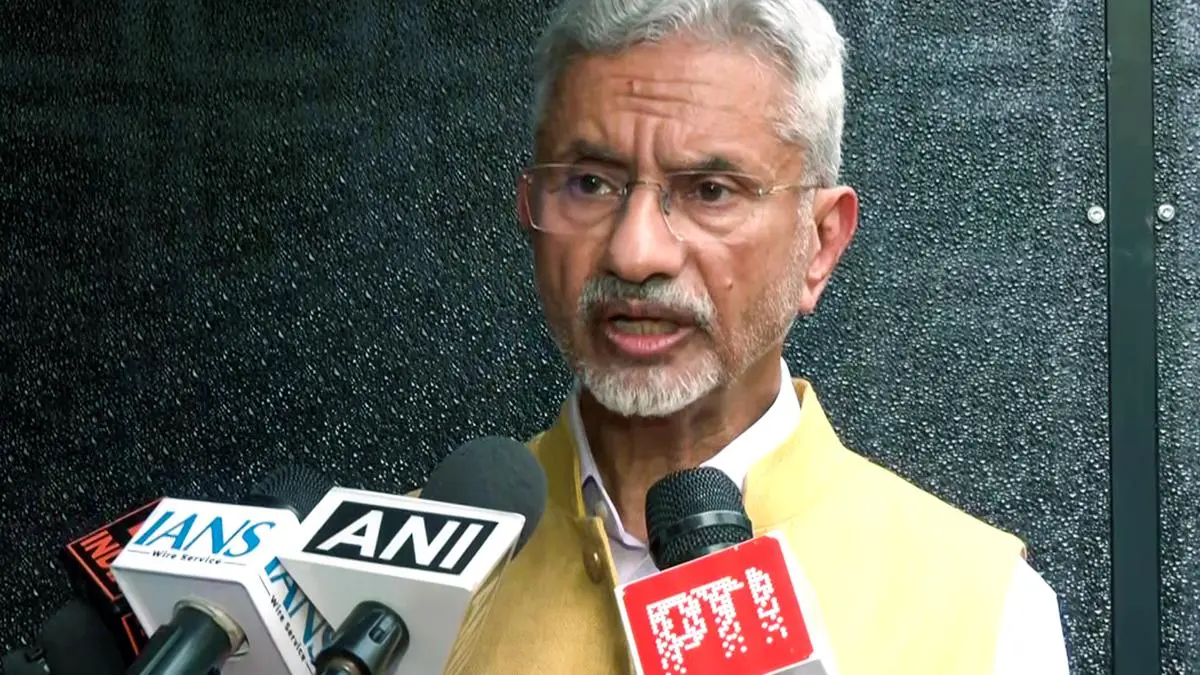

There is scope to bring down tariffs in products which are zero-rated with other FTAs. A deal that brings down tariffs on India’s goods to 10 per cent is possible without much sacrifice. But Trump’s bluff and bluster must be called out, whether it is over trade or matters of national security, even as we keep our ties with US on an even keel. Meanwhile, India sent out another sharp message that it will look out for its interests. In a throwback to Trump 1.0, India has proposed retaliatory action on US’ tariffs on steel and aluminium. However, it needs to work out a plan with respect to other areas as well. At the outset, it should be clear that the US’ interests in India go beyond trade per se to persuading India to alter its regulatory systems with respect to GM food, e-commerce, big tech, pharma and other high tech sectors. It is also keen on access to India’s food (maize and soyabean) and dairy sector, besides selling defence equipment and oil. India has enough in its toolkit to squeeze a deal that does not hurt its interests. A levy on e-commerce monopolies, a cap on royalty payments, applying data localisation rules and compulsory licensing of patented drugs can be used to ward off an adverse outcome. In a move that perhaps marks a shift in the way India is approaching trade talks with the US, the External Affairs Minister S Jaishankar has firmly refuted the US’ claim, made repeatedly in recent weeks, that India has agreed to nil tariffs on US imports. Jaishankar’s statement last week tersely and firmly clarifies that trade talks are in progress, and ‘nothing is decided until everything is decided’. India has cleared the air, and it was high time that it did so. It coincides with the upcoming trade talks between the two countries this week; Commerce and Industries Minister Piyush Goyal is in the US with his team of negotiators.

Business

Editorial. Palatable option

Published on June 8, 2025 Given this situation, the Centre does appear to have struck a reasonable balance. By halving duties on crude edible oil, it has tried to bring down raw material costs for the oil processing and refining industry. The wide difference of 19.25 per cent between crude and refined oils makes it viable for refiners to use idle capacity for profitable operations. Farmer interests have also been kept in mind to an extent, by retaining a 10 per cent tariff on crude oils and not restoring it back to zero duty, as was the case before September 2024. However, the timing of this cut could have been better. Coming just when kharif sowing is picking up steam, the duty cut can prompt farmers to rethink oilseed acreage.The extent of relief to consumers will also depend on whether the extraction and refining industry passes on cost savings. Should it prove tardy in passing on benefits, the Centre can consider slashing tariffs on refined oils too by 5-6 percentage points.Cooking oil has been a key contributor to inflation since September last year (when crude edible oils were raised from 0 to 20 per cent and refined oils from 12.5 to 32.5 per cent). The partial rollback now promises consumers some relief. While the change may also cheer the edible oil processing industry, farmers may need to budget for lower realisations. Tariff decisions on edible oils are a tricky balancing act, given the conflicting interests of consumers, the oil processing industry and farmers. For consumers, the perpetual shortfall in domestic supplies of cooking oil, the near-60 per cent import dependence and concentrated supply origins pose a problem. Soyabean, sunflower and palmoil crop prospects in Malaysia, Indonesia, Argentina or Brazil can trigger high volatility in global oil prices which gets passed on to Indian consumers. Farmers find the oilseed crop less remunerative than crops like paddy, where Minimum Support Prices are backed by assured procurement. Frequent tinkering with edible oil trade and tariff policies add to the uncertainty around realisations for farmers. The domestic solvent extraction and refining industry is plagued by excess capacity. With limited domestic availability of oilseeds, the industry relies on imported crude oils and manages profitable operations only when duty differentials between crude and refined oils are wide.

Published on June 8, 2025 The extent of relief to consumers will also depend on whether the extraction and refining industry passes on cost savings. Should it prove tardy in passing on benefits, the Centre can consider slashing tariffs on refined oils too by 5-6 percentage points.India’s retail inflation has cooled, but one item that has continued to sizzle is cooking oils. The ‘oils and fats’ component of the Consumer Price Index (CPI) has shown a persistent year-on-year escalation of 16-17 per cent in recent months. This is perhaps why the Centre decided to slash import duties on crude edible oils last week, just seven months after sharply hiking it. On May 30, the basic customs duty on crude soyabean, palm and sunflower oil was reduced from 20 per cent to 10 per cent, cutting the effective tariff to 16.5 per cent including cess. Duties on refined oils have been left untouched and remain at an effective 35.75 per cent. Cooking oil has been a key contributor to inflation since September last year (when crude edible oils were raised from 0 to 20 per cent and refined oils from 12.5 to 32.5 per cent). The partial rollback now promises consumers some relief. While the change may also cheer the edible oil processing industry, farmers may need to budget for lower realisations. Tariff decisions on edible oils are a tricky balancing act, given the conflicting interests of consumers, the oil processing industry and farmers. For consumers, the perpetual shortfall in domestic supplies of cooking oil, the near-60 per cent import dependence and concentrated supply origins pose a problem. Soyabean, sunflower and palmoil crop prospects in Malaysia, Indonesia, Argentina or Brazil can trigger high volatility in global oil prices which gets passed on to Indian consumers. Farmers find the oilseed crop less remunerative than crops like paddy, where Minimum Support Prices are backed by assured procurement. Frequent tinkering with edible oil trade and tariff policies add to the uncertainty around realisations for farmers. The domestic solvent extraction and refining industry is plagued by excess capacity. With limited domestic availability of oilseeds, the industry relies on imported crude oils and manages profitable operations only when duty differentials between crude and refined oils are wide.

Business

TCS, Infosys, Wipro, HCLTech: Why the IT stocks’ correction gathers no moss

Published on June 7, 2025

It’s all relative

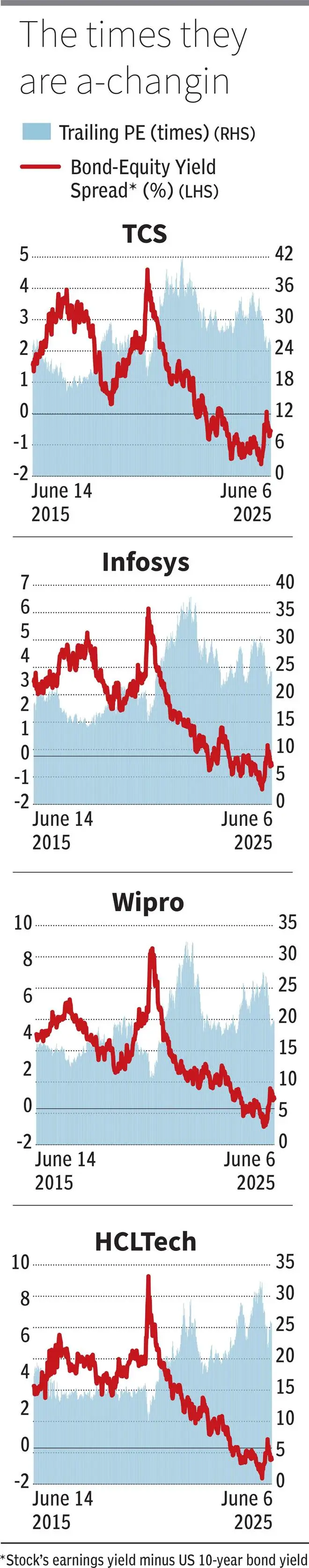

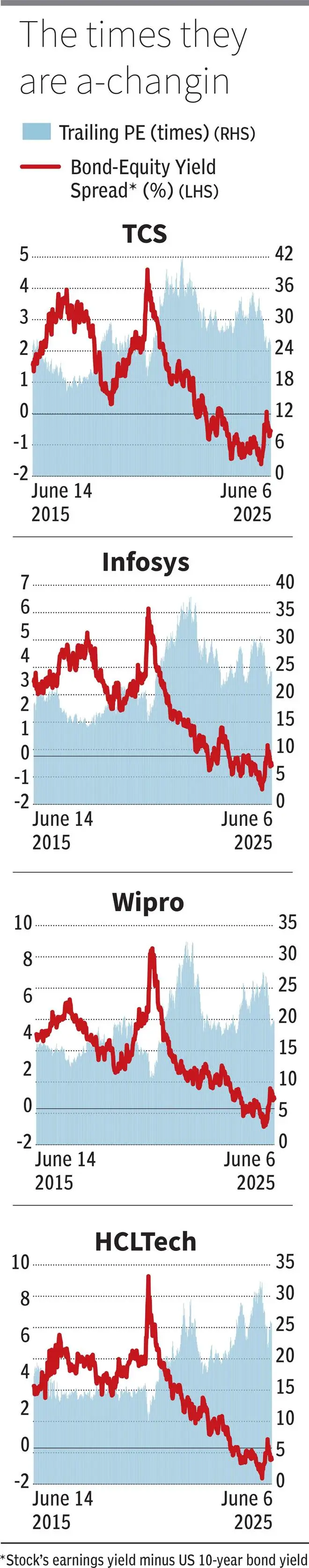

Following this, investors would be tempted to think ‘is the correction over?’ While there has been a severe timewise correction in stocks, unfortunately by one metric they are in their most expensive zone in the last 10 years! This may continue to weigh on shareholder returns.Companies to followNot just TCS, but for its major contemporaries as well — Infosys, Wipro and HCLTech — the period FY24-27 will rank amongst their worst three-year period in terms of growth. In this context, with bond yields globally on the rise and providing attractive yields, it might make FPIs look past these stocks.

The charts compare the bond-equity yield spread for the IT stocks from the perspective of a foreign investor, which is the stock’s earnings yield minus the US 10-year bond yield, for the last 10 years. By this measure although stock valuations (barring HCLTech) have corrected significantly from highs, the irony is that on a relative basis they are hovering around their most expensive levels in the last 10 years.

Hunger for growth

Take TCS – its PE today is bang where it was 10 years back, yet when compared to other investible options from an FPI perspective it is unattractive versus 10 years back. Not only this, equally on the unfavourable side is its growth prospects today. In FY2015, TCS delivered constant currency (CC) revenue growth of 17 per cent — that alone on its own sufficiently justified a 25x PE, leaving apart the attractive bond-equity yield spread. To the contrary, its CC revenue growth in FY25 was just 4.2 per cent.The period since GFC triggered the phase of global investor’s hunger for yields as interest rates in developed markets dropped to near zero or even negative levels. Compared to a 10-year government bonds yielding 0 to 2 per cent, even stocks with PE of 30 times or earnings yield (1/PE) of 3.3 per cent (generally viewed expensive in the pre GFC era) suddenly appeared attractive. As long as the earnings yield was above the government bond yield, and it also came with decent and consistent earnings growth, such stocks found strong favour. IT stocks neatly fitted into this spot.As compared to hunger for yields in the era of low interest rates, global investors are now hungry for growth. High payout ratios — like those seen in IT majors that distribute most of their profits to shareholders instead of reinvesting for growth in new businesses — worked well earlier, but may now put pressure on these companies.Investors will be willing to buy stocks/indices with low or negative bond-equity yield spread if the growth prospects are bright, but currently that is missing for IT majors.

Following this, investors would be tempted to think ‘is the correction over?’ While there has been a severe timewise correction in stocks, unfortunately by one metric they are in their most expensive zone in the last 10 years! This may continue to weigh on shareholder returns.

It’s all relative

As their core IT services business faces competition from GCCs, mid-cap IT players and, more importantly, AI-related disruption, growth may remain lacklustre. Slow growth for three consecutive years may also reflect structural changes beyond cyclical factors.Published on June 7, 2025 Take TCS – its PE today is bang where it was 10 years back, yet when compared to other investible options from an FPI perspective it is unattractive versus 10 years back. Not only this, equally on the unfavourable side is its growth prospects today. In FY2015, TCS delivered constant currency (CC) revenue growth of 17 per cent — that alone on its own sufficiently justified a 25x PE, leaving apart the attractive bond-equity yield spread. To the contrary, its CC revenue growth in FY25 was just 4.2 per cent.

Companies to follow

Hunger for growth

As compared to hunger for yields in the era of low interest rates, global investors are now hungry for growth. High payout ratios — like those seen in IT majors that distribute most of their profits to shareholders instead of reinvesting for growth in new businesses — worked well earlier, but may now put pressure on these companies.The period since GFC triggered the phase of global investor’s hunger for yields as interest rates in developed markets dropped to near zero or even negative levels. Compared to a 10-year government bonds yielding 0 to 2 per cent, even stocks with PE of 30 times or earnings yield (1/PE) of 3.3 per cent (generally viewed expensive in the pre GFC era) suddenly appeared attractive. As long as the earnings yield was above the government bond yield, and it also came with decent and consistent earnings growth, such stocks found strong favour. IT stocks neatly fitted into this spot.Investors will be willing to buy stocks/indices with low or negative bond-equity yield spread if the growth prospects are bright, but currently that is missing for IT majors.With the Nifty 50 scaling 25,000 on Friday and continuing its journey of recouping lost ground from its September 2024 peak, investors in major IT stocks continue to watch from behind. In the last three years, every time the stocks of IT majors — TCS, Infosys, Wipro — have risen, they have done so only to fall again such that their returns are largely flat in this period while the Nifty has zoomed 50 per cent.

Business

Volkswagen Golf GTI: Redemption

You won’t be bothered about any of that the moment you set out for your drive. We had access to the NATRAX test centre near Indore for this drive — including the 11.3 km high-speed circuit — and the GTI showed its true colours. The car epitomises flexibility; you can hoon it around a racetrack, and, without making any mechanical changes, drive it to work like nothing happened, and the car will quite obediently follow your lead. The sleek exterior design draws your attention quickly and is also well-proportioned, but not without great hints of aggression, making the car’s purpose quite evident. There are four exterior colours to choose from, its 18-inch alloy wheels are standard, and there’s no dearth of ‘GTI’ badges. An illuminated strip joins the two headlights, making the Golf GTI ever so slightly more dramatic when it gets dark outside. This is further complemented by an illuminated VW logo, while the trademark red strip across the front, the five-pod fog lights, and the fang-like elements on the lower grille work in tandem to ensure that the GTI’s is a face you wouldn’t forget.

The 12.9-inch touchscreen is the centerpiece — more than just a big display, it’s smartly integrated for enhanced functionality

| Photo Credit: Kaizad Adil Darukhanawala

Start the car in sport mode, and the exhaust has a mild rumble (which isn’t too intrusive), but as revs climb, the engine noise becomes more characterful, and it even emits pops without needing a ‘pops and bangs’ tune from your friendly tuner. The chassis, too, is remarkable, again signifying the Golf GTI’s flexibility. It doesn’t get adaptive dampers, but despite that, the ride is comfortable. In the handling department, the Golf scores quite well. Its nose is eager to follow your steering input although the steering itself feels a bit numb. You can fully deactivate the car’s stability control, but I found that ESC Sport allowed me to push the car without intervening. My only gripe is that while the automatic gearbox is quick to shift, both by itself or when you operate it using the paddle shifters, a car like this deserves to be specced with a manual gearbox.

Start the car in sport mode, and the exhaust has a mild rumble (which isn’t too intrusive), but as revs climb, the engine noise becomes more characterful, and it even emits pops without needing a ‘pops and bangs’ tune from your friendly tuner. The chassis, too, is remarkable, again signifying the Golf GTI’s flexibility. It doesn’t get adaptive dampers, but despite that, the ride is comfortable. In the handling department, the Golf scores quite well. Its nose is eager to follow your steering input although the steering itself feels a bit numb. You can fully deactivate the car’s stability control, but I found that ESC Sport allowed me to push the car without intervening. My only gripe is that while the automatic gearbox is quick to shift, both by itself or when you operate it using the paddle shifters, a car like this deserves to be specced with a manual gearbox. Balanced dynamics

© Motoring WorldNearly a decade ago, Volkswagen India did the unthinkable. It brought to our market a car that seemed impractical, had fewer doors, and was about four times as expensive as the one it was based on. Despite that, it found many takers, quickly helping it attain a legendary status — so much so that used examples show nearly no signs of depreciation, even a decade later. That was the Volkswagen Polo GTI, and now, nine years later, Volkswagen has brought out another GTI; this time, a more powerful and definitely more focussed one. It is the Mk 8.5 Golf GTI, a front-wheel drive hatchback whose badge is considered synonymous with ‘hot hatch’. We take it out for a drive to understand what the fuss is aboutPublished on June 6, 2025 I’ve always adored the Golf GTI, and I’m certain there are many out there who share the same sentiment. Priced at ₹53 lakh, ex-showroom, the Golf GTI isn’t going to be within everyone’s reach, but you know what, if you’ve wanted one badly (and have the means), you would have booked it already. The first lot of 150 cars coming to India is sold out already, which proves my point.

Sleek design

© Motoring World

The 12.9-inch touchscreen is the centerpiece — more than just a big display, it’s smartly integrated for enhanced functionality

| Photo Credit: Kaizad Adil Darukhanawala

I’ve always adored the Golf GTI, and I’m certain there are many out there who share the same sentiment. Priced at ₹53 lakh, ex-showroom, the Golf GTI isn’t going to be within everyone’s reach, but you know what, if you’ve wanted one badly (and have the means), you would have booked it already. The first lot of 150 cars coming to India is sold out already, which proves my point.

Balanced dynamics

There’s no doubt that Volkswagen has been at the top of its hot hatchback game, and we’re pleased to report that the Golf GTI is unchanged for the Indian market. It’s powered by the EA888 2-litre turbocharged petrol engine, which makes 261 bhp and 37.7 kg-m. It powers the front wheels via a 7-speed dual-clutch automatic gearbox and an electronically controlled limited-slip diff. The sleek exterior design draws your attention quickly and is also well-proportioned, but not without great hints of aggression, making the car’s purpose quite evident. There are four exterior colours to choose from, its 18-inch alloy wheels are standard, and there’s no dearth of ‘GTI’ badges. An illuminated strip joins the two headlights, making the Golf GTI ever so slightly more dramatic when it gets dark outside. This is further complemented by an illuminated VW logo, while the trademark red strip across the front, the five-pod fog lights, and the fang-like elements on the lower grille work in tandem to ensure that the GTI’s is a face you wouldn’t forget. Start the car in sport mode, and the exhaust has a mild rumble (which isn’t too intrusive), but as revs climb, the engine noise becomes more characterful, and it even emits pops without needing a ‘pops and bangs’ tune from your friendly tuner. The chassis, too, is remarkable, again signifying the Golf GTI’s flexibility. It doesn’t get adaptive dampers, but despite that, the ride is comfortable. In the handling department, the Golf scores quite well. Its nose is eager to follow your steering input although the steering itself feels a bit numb. You can fully deactivate the car’s stability control, but I found that ESC Sport allowed me to push the car without intervening. My only gripe is that while the automatic gearbox is quick to shift, both by itself or when you operate it using the paddle shifters, a car like this deserves to be specced with a manual gearbox. You won’t be bothered about any of that the moment you set out for your drive. We had access to the NATRAX test centre near Indore for this drive — including the 11.3 km high-speed circuit — and the GTI showed its true colours. The car epitomises flexibility; you can hoon it around a racetrack, and, without making any mechanical changes, drive it to work like nothing happened, and the car will quite obediently follow your lead.

-

india2 years ago

india2 years ago“Major Crash of Sukhoi Su-30 and Mirage 2000 Fighter Jets in Madhya Pradesh”

-

Sports2 years ago

Sports2 years agoWFI meetings on April 16, elections likely to be discussed

-

india1 year ago

india1 year agoPM Modi Meets Deve Gowda for Seat Sharing Talks

-

india1 year ago

india1 year agoBengaluru: False threat to bomb Raj Bhavan

-

india2 years ago

india2 years ago“AIMIM to Contest 50 Seats in Upcoming Telangana Assembly Elections”

-

Entertainment1 year ago

Entertainment1 year agoAnant Ambani: Controversy at the Ambani Pre-Wedding Bash

-

Karnataka2 years ago

Karnataka2 years agoWomen have to show their Aadhaar to travel free on KSRTC bus

-

Entertainment2 years ago

Entertainment2 years agoRajinikanth is Moideen Bhai in ‘Lal Salaam’