Business

HUL, Nestle India, Britannia, Godrej Consumer Products, Marico, Dabur, Emami, Jyothy Labs et al: What’s weighing on the FMCG sector and is demand recovery in sight?

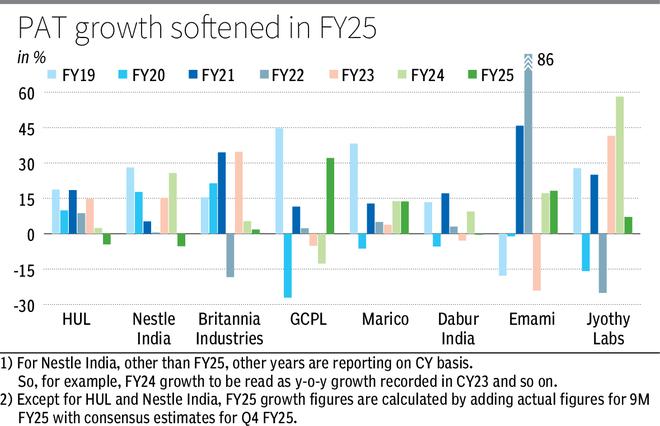

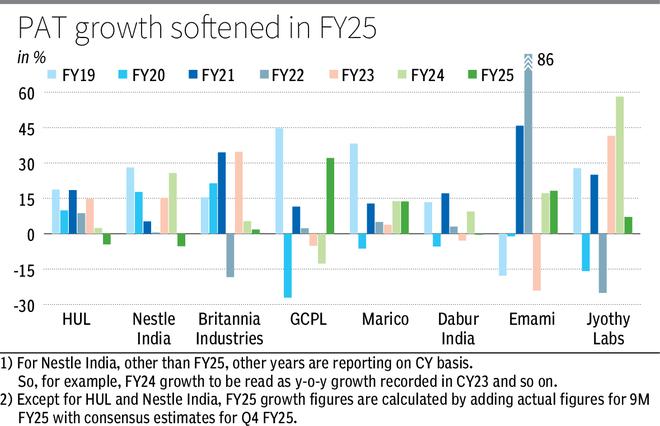

HUL, at 48.8 times its FY26 earnings, despite its market leadership and a discount to its five-year average, might see further deterioration with cut in margin guidance by 100 bps to 22-23 per cent for FY26. Its average volume growth from FY20 stands at 3 per cent, half that of the 7 per cent growth recorded during FY11-19. Dabur, with challenges in pushing sales through general trade might also see a difficult FY26, and trading at around 42 times its FY26 earnings, margin to safety seems minimal.Emami and Jyothy Labs are relatively cheaper, trading at 29 times and 31.8 times their FY26 earnings respectively. Per our recent recommendations, investors can consider accumulating in these counters.Consequently, Jyothy Labs and GCPL saw their EBITDA margin improve 10 bps and 40 bps year on year during 9M FY25. Emami, with improved offtake in its high-margin antiseptic cream and gels, saw its EBITDA and PAT margins expand 50 bps and 110 bps during 9M FY25.

Consumption blues

Softening raw material prices, particularly copra and palm oil, should help improve profitability going ahead. Also, price hike measures still underway, continuing until Q1 FY26, hints at price growth for FY26. But sustained increase in advertising and promotion expenses, to drive volume growth, will continue, limiting the expansion in profit margins. The focus continues to be on volume-driven growth and demand environment is expected to improve starting from Q2 FY26.In macro terms, the urban-rural gap in monthly per capita consumption expenditure is down to 70 per cent in 2023-24 from 84 per cent in 2011-12, signalling steady rural consumption growth. For the urban markets, a rise in disposable income, thanks to tax cuts and panel for the eighth pay commission (expected to come into effect from H2 FY26) to be appointed in the next two-three months, alongside a softening inflation is theoretically a positive set-up.However, post this underperformance, and amid global trade-war driven uncertainties, views now are again emerging in favour of FMCG stocks. But has there been a fair reset in the valuation? What’s weighing on the sector, how are companies responding and what does it all mean for long-term investors? Here is a lowdown.After many seasons of erratic monsoon post-Covid, 9M FY25 saw green shoots with better agricultural output. With the advance estimates of wheat production signalling a strong harvest and the current market prices at a premium to the minimum support price, the recovery in the rural markets seems set to continue into FY26. HUL, on the other hand, in a bid to strengthen general trade, has initiated a direct-to-kirana distribution strategy in Mumbai aimed at faster and reliable deliveries helping retailers avoid large inventory holdings.

Distribution conundrum

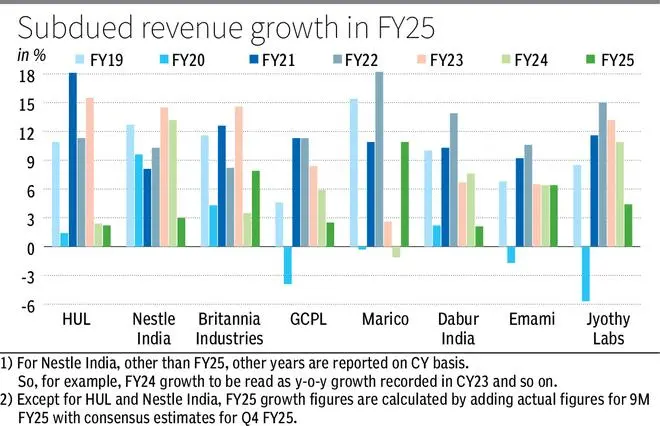

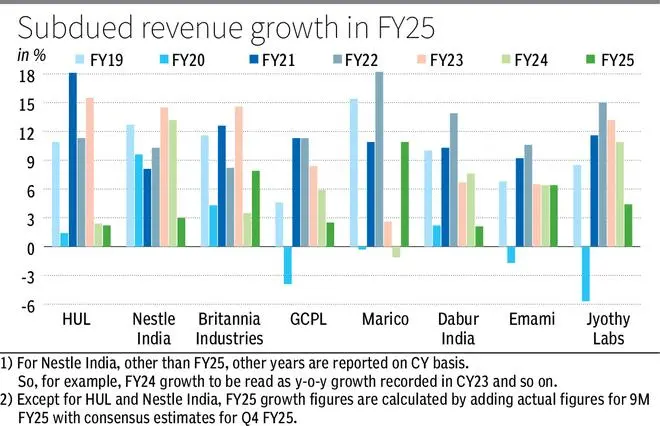

There is an inevitable structural shift taking place in the distribution channels and the go-to-market strategies. So, slowdown apart, changing dynamics, including D2C players gaining market share, also need to be factored while considering investments in the sector.An alternate line of thought gaining ground is that while a slowdown is observed in the growth trajectory of the listed giants, it is not entirely a result of cyclical economic slowdown and inflation in recent years. Corroboration comes from digital-first direct-to-consumer (D2C) brands, with the right formulations, continuing to grow exponentially (albeit on a low base), despite being skewed towards the urban premium. Food & BeverageWhile general trade still contributes more than half of the sector’s revenue currently, modern trade channels (including online channels) are leading the growth with healthy double-digit, year-on-year gains.Almost the entire FMCG pack forecasted a double-digit volume growth for FY25, at least from H2 FY25, with a gradual recovery in rural, while urban continues its growth trajectory. But what actually played out has been starkly different. While rural markets, which were a drag post Covid, recovered from Q4 FY24, urban markets which carried the mantle until FY24 are underperforming now.There were times when players in the industry could flex their muscles stating their huge network of distributors and kirana store retailers. HUL’s EBITDA margins were down 21 bps for FY25, while that of Marico and Dabur also dropped 70 bps and 74 bps during 9M FY25, owing to inflation in prices of palm oil, copra and fruit concentrates respectively, their key raw materials. But now some of the above factors have taken a hit. Recent years have shown that volume and earnings growth may not be consistent, and global liquidity has significantly tightened. Zero or ultra-low interest rates in developed markets meant that an FMCG stock priced at 75 times its earnings could even be attractive for a foreign investor. This is not the case anymore, with risk-free government bonds in developed markets giving attractive yields relative to high-PE FMCG stocks. So the levers for premium valuation are waning. Home & Personal CareThe recent financial performance of players, part of the FMCG index and also under our coverage, validate the evolving demand trends and shifts in margin dynamics across the sector.Home and Personal care segment continued to be the largest and fastest growing segment for HUL and Dabur.

Momentum check

But disruption has come via quick commerce (q-commerce). Though e-commerce was already in the fray, the real disruption was brought about by q-commerce, being the real alternative to the kirana stores, meeting your last-minute needs.Improved product mix helped Emami, Jyothy Labs and Godrej Consumer Products (GCPL) with their profit margins. The growth and increased penetration in high-margin liquid detergents also helped Jyothy Labs and GCPL with their profitability.To address some of the challenges here, the industry giants have warmed up to acquisitions. With healthy cash generation every year, the M&A playbook has always been integral to the incumbents. Acquiring emerging D2C brands, apart from adding to the product portfolio, has also helped expand their digital presence.Q-commerce has diluted the significance of a distribution network. Minimal investments in distribution networks meant that the focus could be channelled towards new product development and promotions. A rising quality-consciousness among consumers further levelled the field and D2C brands, with the right formulation and a focus on ingredient composition, have managed to score big. Earning brand loyalty, consequently, is more difficult now than it ever has been. This is where the sector giants are facing competition from emerging players. But the last five years tell a totally different story with Nifty FMCG index returning just 95 per cent, while Nifty 50 zoomed 159 per cent. Industry leaders like HUL and Nestle India even underperformed the sectoral index, returning a meagre 0.5 per cent and 34.5 per cent during the same period.The scale-up pace will be a key monitorable here.At the start of 2010, the Nifty FMCG index was valued at 30 times its earnings. The decade that followed (2010-19) saw earnings grow at a 13.6 per cent CAGR, while the index grew at a significantly higher CAGR of 17.1 per cent, stretching the valuation to 40 times its earnings, as at the end of 2019. While a burgeoning middle-income group drove business and earnings growth, the valuation re-rating was driven by low global interest rates and liquidity gush. Besides, investor confidence in consistency of earnings growth with most companies in the sector regarded as quality stocks, backed by a strong track record of execution and sound corporate governance added fuel. Also, the capex cycle taking a hit due to the bank clean-up during the decade meant that consumer non-discretionary plays were relatively better bets. However, urban markets are seeing premiumisation as a key trend with mass-market products, which drive the bulk of FMCG business, underperforming. And interestingly, many companies saw small packs flying off the shelves faster in Q3 FY25, which could be a sign of distress.

Outlook

Published on April 26, 2025 The Nifty FMCG index has corrected from a peak PE of 52.8 times in January 2024 to 44.3 times now. But it is still at a premium to its five-year average of 42.6 times. The pre-Covid five-year average PE is at a much lower 40.2 times, signalling that the correction might be underdone. However, these acquisitions were, more often than not, worked out at steep valuations and do not materially add to the acquirers’ topline immediately. For example, HUL’s acquisition of The Minimalist was valued at an expensive 8.5 times its FY24 revenue of ₹347 crore. But it only adds around 0.6 per cent to HUL’s FY25 revenue.

Valuation

The industry will continue to grow, but the pace at which it comes is the million-dollar-question. For the near term, changing dynamics in the distribution channels might have an impact, but in the long term, premiumisation is expected to continue being the driving factor with a focus on the product portfolio. Under-penetrated categories such as body wash liquids, functional nutritional drinks, household insecticides, oral care and hair care products could drive faster growth for Emami, Jyothy Labs, GCPL and Marico.High valuation multiples always work against share appreciation unless growth is consistent. All hinges on volume growth recovery for the industry. And at this juncture, valuation is the most critical factor for investors to find investment opportunities in this sector. Hence, tempered expectations and selective stock-picking should be the way to go.

HUL, looking to expand its offerings under the beauty and wellbeing (B&WB) segment, bought out The Minimalist in Q3 FY25. Emami, meanwhile, acquired The Man Company and Brillare Sciences, operating in the same B&WB segment. Marico, too, acquired four D2C companies – Beardo, True Elements, Just Herbs and Plix.In the earlier structure, emerging brands were stonewalled by the distribution network, but now they can compete better. And the D2C/emerging brands have turned out to be the quiet, industrious ants to the elephant-esque legacy players.While globally, FMCG/ consumer non-discretionary sectors are viewed as defensive plays, in India, for over a decade, they also served as aggressive growth bets. Why not, when GDP was growing consistently in mid- to high-single digits pulling up millions of people out of poverty and pushing them into the consumption class! On top of this, a rising affluent middle-class drove increased demand. The theme played out so well between 2010 and 2019 with Nifty FMCG index delivering 263 per cent, significantly outperforming Nifty 50 which delivered 128 per cent. HUL and Nestle India were bumper hits during this period, returning 515 per cent and 288 per cent respectively. Nestle India continues to be the most expensive, trading at 68.7 times. Marico, trading at 50.6 times its FY26 earnings, is still at a 14 per cent premium to its five-year average, leaving little room to err. Similarly, Britannia is trading at an 11 per cent premium to its five-year average and GCPL at a premium of 19 per cent. With the urban distribution channels disrupted by q-commerce, the companies have started consolidating their urban outreach, focusing on ‘high-potential outlets’, while continuing to expand their rural outreach. Companies are now even tailoring SKUs by channel to spur growth.Both Britannia and Nestle India undertook price hikes to protect their margins on account of sustained inflation in input costs. But having been late to pass on the rising input prices, despite the volume growth of around 6-8 per cent year on year during 9M FY25, Britannia’s revenue grew just 4.6 per cent. Though marginally better than FY24’s 3.5 per cent and FY20’s 4.3 per cent, it is the slowest since FY03. EBITDA margin was down 100 basis points (bps). Nestle India, similarly, found its EBITDA margin down 59 bps, while revenue grew just 3 per cent (its lowest since FY16), resulting in EBITDA being flat.

There were times when players in the industry could flex their muscles stating their huge network of distributors and kirana store retailers. However, these acquisitions were, more often than not, worked out at steep valuations and do not materially add to the acquirers’ topline immediately. For example, HUL’s acquisition of The Minimalist was valued at an expensive 8.5 times its FY24 revenue of ₹347 crore. But it only adds around 0.6 per cent to HUL’s FY25 revenue. The scale-up pace will be a key monitorable here.

Consumption blues

While general trade still contributes more than half of the sector’s revenue currently, modern trade channels (including online channels) are leading the growth with healthy double-digit, year-on-year gains.Consequently, Jyothy Labs and GCPL saw their EBITDA margin improve 10 bps and 40 bps year on year during 9M FY25. Emami, with improved offtake in its high-margin antiseptic cream and gels, saw its EBITDA and PAT margins expand 50 bps and 110 bps during 9M FY25.High valuation multiples always work against share appreciation unless growth is consistent. All hinges on volume growth recovery for the industry. And at this juncture, valuation is the most critical factor for investors to find investment opportunities in this sector. Hence, tempered expectations and selective stock-picking should be the way to go.HUL, on the other hand, in a bid to strengthen general trade, has initiated a direct-to-kirana distribution strategy in Mumbai aimed at faster and reliable deliveries helping retailers avoid large inventory holdings.Q-commerce has diluted the significance of a distribution network. Minimal investments in distribution networks meant that the focus could be channelled towards new product development and promotions. A rising quality-consciousness among consumers further levelled the field and D2C brands, with the right formulation and a focus on ingredient composition, have managed to score big. Earning brand loyalty, consequently, is more difficult now than it ever has been. This is where the sector giants are facing competition from emerging players.

Distribution conundrum

Almost the entire FMCG pack forecasted a double-digit volume growth for FY25, at least from H2 FY25, with a gradual recovery in rural, while urban continues its growth trajectory. But what actually played out has been starkly different. While rural markets, which were a drag post Covid, recovered from Q4 FY24, urban markets which carried the mantle until FY24 are underperforming now.HUL, looking to expand its offerings under the beauty and wellbeing (B&WB) segment, bought out The Minimalist in Q3 FY25. Emami, meanwhile, acquired The Man Company and Brillare Sciences, operating in the same B&WB segment. Marico, too, acquired four D2C companies – Beardo, True Elements, Just Herbs and Plix.HUL’s EBITDA margins were down 21 bps for FY25, while that of Marico and Dabur also dropped 70 bps and 74 bps during 9M FY25, owing to inflation in prices of palm oil, copra and fruit concentrates respectively, their key raw materials. Food & BeverageThe industry will continue to grow, but the pace at which it comes is the million-dollar-question. For the near term, changing dynamics in the distribution channels might have an impact, but in the long term, premiumisation is expected to continue being the driving factor with a focus on the product portfolio. Under-penetrated categories such as body wash liquids, functional nutritional drinks, household insecticides, oral care and hair care products could drive faster growth for Emami, Jyothy Labs, GCPL and Marico.The Nifty FMCG index has corrected from a peak PE of 52.8 times in January 2024 to 44.3 times now. But it is still at a premium to its five-year average of 42.6 times. The pre-Covid five-year average PE is at a much lower 40.2 times, signalling that the correction might be underdone. In macro terms, the urban-rural gap in monthly per capita consumption expenditure is down to 70 per cent in 2023-24 from 84 per cent in 2011-12, signalling steady rural consumption growth. For the urban markets, a rise in disposable income, thanks to tax cuts and panel for the eighth pay commission (expected to come into effect from H2 FY26) to be appointed in the next two-three months, alongside a softening inflation is theoretically a positive set-up.Home and Personal care segment continued to be the largest and fastest growing segment for HUL and Dabur.While globally, FMCG/ consumer non-discretionary sectors are viewed as defensive plays, in India, for over a decade, they also served as aggressive growth bets. Why not, when GDP was growing consistently in mid- to high-single digits pulling up millions of people out of poverty and pushing them into the consumption class! On top of this, a rising affluent middle-class drove increased demand. The theme played out so well between 2010 and 2019 with Nifty FMCG index delivering 263 per cent, significantly outperforming Nifty 50 which delivered 128 per cent. HUL and Nestle India were bumper hits during this period, returning 515 per cent and 288 per cent respectively. Nestle India continues to be the most expensive, trading at 68.7 times. Marico, trading at 50.6 times its FY26 earnings, is still at a 14 per cent premium to its five-year average, leaving little room to err. Similarly, Britannia is trading at an 11 per cent premium to its five-year average and GCPL at a premium of 19 per cent. After many seasons of erratic monsoon post-Covid, 9M FY25 saw green shoots with better agricultural output. With the advance estimates of wheat production signalling a strong harvest and the current market prices at a premium to the minimum support price, the recovery in the rural markets seems set to continue into FY26.

Momentum check

However, urban markets are seeing premiumisation as a key trend with mass-market products, which drive the bulk of FMCG business, underperforming. And interestingly, many companies saw small packs flying off the shelves faster in Q3 FY25, which could be a sign of distress. Both Britannia and Nestle India undertook price hikes to protect their margins on account of sustained inflation in input costs. But having been late to pass on the rising input prices, despite the volume growth of around 6-8 per cent year on year during 9M FY25, Britannia’s revenue grew just 4.6 per cent. Though marginally better than FY24’s 3.5 per cent and FY20’s 4.3 per cent, it is the slowest since FY03. EBITDA margin was down 100 basis points (bps). Nestle India, similarly, found its EBITDA margin down 59 bps, while revenue grew just 3 per cent (its lowest since FY16), resulting in EBITDA being flat. The recent financial performance of players, part of the FMCG index and also under our coverage, validate the evolving demand trends and shifts in margin dynamics across the sector.But the last five years tell a totally different story with Nifty FMCG index returning just 95 per cent, while Nifty 50 zoomed 159 per cent. Industry leaders like HUL and Nestle India even underperformed the sectoral index, returning a meagre 0.5 per cent and 34.5 per cent during the same period.At the start of 2010, the Nifty FMCG index was valued at 30 times its earnings. The decade that followed (2010-19) saw earnings grow at a 13.6 per cent CAGR, while the index grew at a significantly higher CAGR of 17.1 per cent, stretching the valuation to 40 times its earnings, as at the end of 2019. While a burgeoning middle-income group drove business and earnings growth, the valuation re-rating was driven by low global interest rates and liquidity gush. Besides, investor confidence in consistency of earnings growth with most companies in the sector regarded as quality stocks, backed by a strong track record of execution and sound corporate governance added fuel. Also, the capex cycle taking a hit due to the bank clean-up during the decade meant that consumer non-discretionary plays were relatively better bets. Improved product mix helped Emami, Jyothy Labs and Godrej Consumer Products (GCPL) with their profit margins. The growth and increased penetration in high-margin liquid detergents also helped Jyothy Labs and GCPL with their profitability.But disruption has come via quick commerce (q-commerce). Though e-commerce was already in the fray, the real disruption was brought about by q-commerce, being the real alternative to the kirana stores, meeting your last-minute needs.With the urban distribution channels disrupted by q-commerce, the companies have started consolidating their urban outreach, focusing on ‘high-potential outlets’, while continuing to expand their rural outreach. Companies are now even tailoring SKUs by channel to spur growth.

Outlook

Published on April 26, 2025 In the earlier structure, emerging brands were stonewalled by the distribution network, but now they can compete better. And the D2C/emerging brands have turned out to be the quiet, industrious ants to the elephant-esque legacy players.However, post this underperformance, and amid global trade-war driven uncertainties, views now are again emerging in favour of FMCG stocks. But has there been a fair reset in the valuation? What’s weighing on the sector, how are companies responding and what does it all mean for long-term investors? Here is a lowdown.

Valuation

Softening raw material prices, particularly copra and palm oil, should help improve profitability going ahead. Also, price hike measures still underway, continuing until Q1 FY26, hints at price growth for FY26. But sustained increase in advertising and promotion expenses, to drive volume growth, will continue, limiting the expansion in profit margins. The focus continues to be on volume-driven growth and demand environment is expected to improve starting from Q2 FY26.There is an inevitable structural shift taking place in the distribution channels and the go-to-market strategies. So, slowdown apart, changing dynamics, including D2C players gaining market share, also need to be factored while considering investments in the sector.

But now some of the above factors have taken a hit. Recent years have shown that volume and earnings growth may not be consistent, and global liquidity has significantly tightened. Zero or ultra-low interest rates in developed markets meant that an FMCG stock priced at 75 times its earnings could even be attractive for a foreign investor. This is not the case anymore, with risk-free government bonds in developed markets giving attractive yields relative to high-PE FMCG stocks. So the levers for premium valuation are waning. An alternate line of thought gaining ground is that while a slowdown is observed in the growth trajectory of the listed giants, it is not entirely a result of cyclical economic slowdown and inflation in recent years. Corroboration comes from digital-first direct-to-consumer (D2C) brands, with the right formulations, continuing to grow exponentially (albeit on a low base), despite being skewed towards the urban premium. To address some of the challenges here, the industry giants have warmed up to acquisitions. With healthy cash generation every year, the M&A playbook has always been integral to the incumbents. Acquiring emerging D2C brands, apart from adding to the product portfolio, has also helped expand their digital presence.Home & Personal CareHUL, at 48.8 times its FY26 earnings, despite its market leadership and a discount to its five-year average, might see further deterioration with cut in margin guidance by 100 bps to 22-23 per cent for FY26. Its average volume growth from FY20 stands at 3 per cent, half that of the 7 per cent growth recorded during FY11-19. Dabur, with challenges in pushing sales through general trade might also see a difficult FY26, and trading at around 42 times its FY26 earnings, margin to safety seems minimal.Emami and Jyothy Labs are relatively cheaper, trading at 29 times and 31.8 times their FY26 earnings respectively. Per our recent recommendations, investors can consider accumulating in these counters.

Business

Dow Jones, S&P 500, Nasdaq Composite: Bond tantrums put Trump on notice, again

So while Trump’s tariff war escalation last Friday may have its roots in an attempt to cool bond yields by targeting eurozone and not the three largest holders of US treasury bonds — Japan, the UK and China — the risk is rising that his administration may lose control of the narrative if the flip flops continue.

Double talk

Thus, with the spike last week Trump was put on notice again by the bond vigilantes. The problem for him is it is now becoming a frequent occurrence — first in early January this year, then in April and now again!All above factors combined now pose a strong hurdle for US and global equity markets. The strong recovery in Dow Jones, S&P 500 and Nasdaq Composite from the lows of April is likely to reverse from here if bond yields continue to inch up. It would be worth noting that last Thursday at around 1 PM New York Time, the US indices posted a sharp intra-day reversal to the downside when an auction for billion worth of new 20-yr Treasury Bonds witnessed weak demand, and the yields spiked.

Meanwhile, gold might continue to find takers as uncertainty reigns.Adding pressure now are bond tantrums playing out in Japan. The Japanese 30 year bond yields too spiked last week and at highest levels on record. With it comes pressure on the Japan government (largest holder of US treasuries) and private investors to reconsider their US Treasury investments.However, in recent weeks, with the administration working hard to pass ‘The One Big Beautiful Bill’ focussed on tax cuts which will also increase the debt ceiling, bond investors seem to be getting spooked again. Especially when this is happening in the backdrop of the US ratings downgrade.Escalating tariff wars is causing fear that China or other countries could retaliate by selling treasury bonds sending yields higher, while de-escalation in tariff wars, combined with increase in debt ceiling, is causing concerns that economy will overheat and inflation will spike up, resulting in the current bond tantrum.

Japanese bonds

Last week, Bessent said the US would deal with debt by ensuring the economy grows faster than the increase in debt. This means he is not looking for ‘detox’ in economy, but for it to grow faster.The bond market loved this and long- term treasury bond yields were falling until early April when some unexpected and unorderly winding of positions caused the yields to spike again (while there were views that this was possibly because of China selling US bonds in retaliation to US tariffs, the final verdict in this is not yet out).

Equity markets

At that time, bond market veteran Jim Bianco posted on X highlighting the irresistible force of the bond market by quoting James Carville (Bill Clinton’s political advisor) who had said, “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”Was US President Donald Trump’s U-turn to escalate the trade war last Friday by threatening high tariffs on the EU and iPhone maker Apple, in a week when US 30-year treasury yields hit their highest levels since 2007, just a co-incidence? For, if you go back a few weeks ago, to early April, he made a similar U-turn to pause the reciprocal tariffs for 90 days in the very week the US 10-year bond yields had their biggest one week spike (50 bps) since 2001.Indian bond markets reflect an oasis of calm amidst these tantrums. The risk for domestic equity investors, however, may stem from how FPIs react now.After all, when sovereign bond yields spike, all finance costs increase and have to adjust accordingly — the risk free rate increases, the interest rates of borrowers (government and private) increase and fiscal deficit as percentage of GDP, too, increases given the higher interest rates upon the bloated leverage of governments in developed economies like the US and Japan. All of these have implications for equities/valuations as well although they may take time to play out.

Indian bond markets reflect an oasis of calm amidst these tantrums. The risk for domestic equity investors, however, may stem from how FPIs react now.

Double talk

Meanwhile, gold might continue to find takers as uncertainty reigns.Was US President Donald Trump’s U-turn to escalate the trade war last Friday by threatening high tariffs on the EU and iPhone maker Apple, in a week when US 30-year treasury yields hit their highest levels since 2007, just a co-incidence? For, if you go back a few weeks ago, to early April, he made a similar U-turn to pause the reciprocal tariffs for 90 days in the very week the US 10-year bond yields had their biggest one week spike (50 bps) since 2001.The bond market loved this and long- term treasury bond yields were falling until early April when some unexpected and unorderly winding of positions caused the yields to spike again (while there were views that this was possibly because of China selling US bonds in retaliation to US tariffs, the final verdict in this is not yet out).Thus, with the spike last week Trump was put on notice again by the bond vigilantes. The problem for him is it is now becoming a frequent occurrence — first in early January this year, then in April and now again!This is a complete about shift in their agenda. The important thing to note here is that, it now appears that Trump could be in a position of ‘damned if you do it and damned if you don’t’.In recent weeks, there has been what one can term as double talk or misleading contradictory signals on economic agenda of the Trump administration. From start of Trump 2.0 till mid-April and especially during days of deep correction in markets following reciprocal tariffs, Treasury Secretary Scott Bessent was out pushing across strongly that the US economy needed a ‘detox’ from excessive government spending.

At that time, bond market veteran Jim Bianco posted on X highlighting the irresistible force of the bond market by quoting James Carville (Bill Clinton’s political advisor) who had said, “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”Escalating tariff wars is causing fear that China or other countries could retaliate by selling treasury bonds sending yields higher, while de-escalation in tariff wars, combined with increase in debt ceiling, is causing concerns that economy will overheat and inflation will spike up, resulting in the current bond tantrum.

Equity markets

However, in recent weeks, with the administration working hard to pass ‘The One Big Beautiful Bill’ focussed on tax cuts which will also increase the debt ceiling, bond investors seem to be getting spooked again. Especially when this is happening in the backdrop of the US ratings downgrade.All above factors combined now pose a strong hurdle for US and global equity markets. The strong recovery in Dow Jones, S&P 500 and Nasdaq Composite from the lows of April is likely to reverse from here if bond yields continue to inch up. It would be worth noting that last Thursday at around 1 PM New York Time, the US indices posted a sharp intra-day reversal to the downside when an auction for billion worth of new 20-yr Treasury Bonds witnessed weak demand, and the yields spiked. As it is, a falling $ and falling US bonds (US yields spike) is a double whammy for the value of their US bonds. This is now combined with their domestic bond market rout making Japanese bonds more attractive. Hence, according to some macro experts, there is a risk of similar type of volatility caused by the Yen carrytrade unwinding that happened in August last year.Adding pressure now are bond tantrums playing out in Japan. The Japanese 30 year bond yields too spiked last week and at highest levels on record. With it comes pressure on the Japan government (largest holder of US treasuries) and private investors to reconsider their US Treasury investments.

Business

India maintains status quo with Pakistan on airspace access: Minister

Published on May 23, 2025

“Indian airspace is not available for Pakistan-registered aircraft and aircraft operated or owned or leased by Pakistan airlines or operators, including military flights,” the NOTAM read.The move came after Pakistan extended its NOTAM, which is meant to cut access to its airspace for India-based airlines. Accordingly, the NOTAM’s scope of restriction issued for FIRs (Flight Information Regions) covered major Indian airspace regions.“We are maintaining status quo right now.”India’s airspace remains closed for Pakistan-registered airlines as well as aircraft, thereby maintaining a status quo with the policy of the neighbouring country, said Union Civil Aviation Minister Ram Mohan Naidu on Friday.

Business

US Homeland Security blocks Harvard’s ability to enroll international students

U.S. President Donald Trump’s administration has revoked Harvard University’s ability to enroll international students, and will force existing students to transfer to other schools or lose their legal status, the Department of Homeland Security said on Thursday.”The government’s action is unlawful. We are fully committed to maintaining Harvard’s ability to host international students and scholars, who hail from more than 140 countries and enrich the University – and this nation – immeasurably, the university said in a statement. “The move comes after Harvard refused to provide information Noem had previously demanded about some foreign student visa holders who attend the university, the department said.”This administration is holding Harvard accountable for fostering violence, antisemitism, and coordinating with the Chinese Communist Party on its campus,” Noem said. “It is a privilege, not a right, for universities to enroll foreign students and benefit from their higher tuition payments to help pad their multibillion-dollar endowments.”The move marks a significant escalation of the Trump administration’s campaign against the elite Ivy League university in Cambridge, Massachusetts, which has emerged as one of Trump’s most prominent institutional targets.Published on May 23, 2025 Homeland Security Secretary Kristi Noem ordered the department to terminate the Harvard University’s Student and Exchange Visitor Program (SEVP) certification, the department said in a statement.The White House did not immediately respond to requests for comment.Harvard said the move threatens serious harm to the university.

Harvard called the action illegal.”The government’s action is unlawful. We are fully committed to maintaining Harvard’s ability to host international students and scholars, who hail from more than 140 countries and enrich the University – and this nation – immeasurably, the university said in a statement. “Published on May 23, 2025 The White House did not immediately respond to requests for comment.Harvard said the move threatens serious harm to the university.The move marks a significant escalation of the Trump administration’s campaign against the elite Ivy League university in Cambridge, Massachusetts, which has emerged as one of Trump’s most prominent institutional targets.

-

india2 years ago

india2 years ago“Major Crash of Sukhoi Su-30 and Mirage 2000 Fighter Jets in Madhya Pradesh”

-

Sports2 years ago

Sports2 years agoWFI meetings on April 16, elections likely to be discussed

-

india1 year ago

india1 year agoPM Modi Meets Deve Gowda for Seat Sharing Talks

-

india1 year ago

india1 year agoBengaluru: False threat to bomb Raj Bhavan

-

india2 years ago

india2 years ago“AIMIM to Contest 50 Seats in Upcoming Telangana Assembly Elections”

-

Entertainment1 year ago

Entertainment1 year agoAnant Ambani: Controversy at the Ambani Pre-Wedding Bash

-

Karnataka2 years ago

Karnataka2 years agoWomen have to show their Aadhaar to travel free on KSRTC bus

-

Entertainment2 years ago

Entertainment2 years agoRajinikanth is Moideen Bhai in ‘Lal Salaam’