Business

Analysts seek visibility on tariff impacts on bottomlines, margins

IT analysts have been grilling the top CXOs of top-tier companies like TCS, Infosys and Wipro to get a visibility on the terrain in the backdrop of tariffs. K Krithivasan, Chief Executive Officer and Managing Director of TCS, said that the Consumer Business Group saw heightened caution and delays in discretionary projects, especially in the US.Jayesh Sanghrajka, Chief Financial Officer (CFO) of Infosys, tariffs and trade barriers were likely to lead to a subdued spend and delayed decision-making.

The impact

Based on client conversations, large transformation projects are being paused or delayed. Clients with budgets are waiting for certainty about the situation before moving forward.There is some impact across the board, but there are some sectors more impacted than others. “For instance, our consumer business, you’re seeing more impact like retail, CPG, airlines, travel hospitality, we see more impact. Similarly, there is an impact in the auto sub segment within manufacturing. But if you take BFSI, by and large the segment is doing okay. There is some softness in insurance,” he said.“Retail sector has been impacted by economic uncertainty resulting in lower consumer spending in core markets. Due to recent tariff announcements, client budgets are expected to be tightened and there is increased caution. Decision cycles are getting stretched for discretionary spend and large deals,” he said.Pallia said that after the pause for 90 days on the tariffs, there was a little bit of stability over the last two few weeks.

Uncertain economic environment

In the recent earnings call, he said that it was driven by the significant drop in consumer sentiment in February, which had preceded changes in global trade and tariffs, creating a domino effect on retail CPG and TTH (travel, transportation, and hospitality) industries.“The impact of tariffs on IT service providers will be a function of their portfolio of offerings and end markets,” Prashant Shukla, vice president, Everest Group, said. “Weakness in auto, especially in Europe continues. We are helping clients in aerospace resolve bottleneck in the supply chain,” he said. “For instance, in terms of topline and deal pipelines, part of portfolio which is discretionary in nature with exposure to directly impacted industries like manufacturing will suffer much more than, say, an essential, non-discretionary service with industry which is not directly impacted by tariffs, like banking. In short to medium term, cost-optimisation services will see more takers,” he said.Published on April 28, 2025 “We are seeing this impact not just in the US, but also in Europe. Similarly, these impacts are being seen across sectors, directly or indirectly. But some sectors have been impacted more, like consumer, manufacturing. Within manufacturing, specifically automotive and industrial, are impacted,” he said, responding to a query.Even as reciprocal tariffs by US President Donald Trump trigger an economic chaos across the world, IT analysts and investors are trying to weight how these tariffs could impact the bottomlines and margins of IT companies.He said the clients in all the industries were taking a lot more cautious approach. “And they’re also doing scenario planning, because they would like to see when this whole thing is settled down, before they start making more business decisions,” he said.

The impact

“We are seeing this impact not just in the US, but also in Europe. Similarly, these impacts are being seen across sectors, directly or indirectly. But some sectors have been impacted more, like consumer, manufacturing. Within manufacturing, specifically automotive and industrial, are impacted,” he said, responding to a query.“Retail sector has been impacted by economic uncertainty resulting in lower consumer spending in core markets. Due to recent tariff announcements, client budgets are expected to be tightened and there is increased caution. Decision cycles are getting stretched for discretionary spend and large deals,” he said.Srini Pallia, CEO and MD of Wipro Ltd, felt that the economic environment had become uncertain on the back of tariff increases.Pallia said that after the pause for 90 days on the tariffs, there was a little bit of stability over the last two few weeks.

Uncertain economic environment

Even as reciprocal tariffs by US President Donald Trump trigger an economic chaos across the world, IT analysts and investors are trying to weight how these tariffs could impact the bottomlines and margins of IT companies.“The impact of tariffs on IT service providers will be a function of their portfolio of offerings and end markets,” Prashant Shukla, vice president, Everest Group, said. “For instance, in terms of topline and deal pipelines, part of portfolio which is discretionary in nature with exposure to directly impacted industries like manufacturing will suffer much more than, say, an essential, non-discretionary service with industry which is not directly impacted by tariffs, like banking. In short to medium term, cost-optimisation services will see more takers,” he said.

There is some impact across the board, but there are some sectors more impacted than others. “For instance, our consumer business, you’re seeing more impact like retail, CPG, airlines, travel hospitality, we see more impact. Similarly, there is an impact in the auto sub segment within manufacturing. But if you take BFSI, by and large the segment is doing okay. There is some softness in insurance,” he said.He said the clients in all the industries were taking a lot more cautious approach. “And they’re also doing scenario planning, because they would like to see when this whole thing is settled down, before they start making more business decisions,” he said.“Weakness in auto, especially in Europe continues. We are helping clients in aerospace resolve bottleneck in the supply chain,” he said. IT analysts have been grilling the top CXOs of top-tier companies like TCS, Infosys and Wipro to get a visibility on the terrain in the backdrop of tariffs. K Krithivasan, Chief Executive Officer and Managing Director of TCS, said that the Consumer Business Group saw heightened caution and delays in discretionary projects, especially in the US.

Business

Editorial. Not so poor

Some of the brief’s observations are puzzling. For instance, the view that “recent data indicates a shift of male workers from rural to urban areas for the first time since 2018-19” does not sit well with Periodic Labour Force Survey data on rising workforce in agriculture in recent years — or for that matter, arguably with a December 2024 study by the Economic Advisory Council to the Prime Minister that points to a decline in rural to urban migration over a decade. The data noise with respect to India’s socio-economic profile needs serious attention.

Published on April 27, 2025 The numerous DBT schemes could be meeting consumption needs in ways that are not entirely understood. Therefore, ‘freebies’ need to be understood in a more granular way with a view to rationalising them, as each could be distinct in its impact. The brief, which derives its conclusions from the HCESs of 2011-12 and 2022-23, also observes a decline in consumption-based inequality, but adds a caveat that this may not be borne out by income-based inequality assessments. It acknowledges that changes in methodology in HCES 2022-23 over its decade-ago version “present challenges for making comparisons”. The HCES data suggests that the urban-rural gap narrowed from 84 per cent in 2011-12 to 71 per cent in 2022-23 and further to 70 per cent in 2023-24. The brief, meanwhile, makes a sobering observation that the median earnings of the top 10 per cent were 13 times higher than the bottom 10 per cent in 2023-24. Owing to methodological issues, it is hard to say whether this marks an improvement over time.

Business

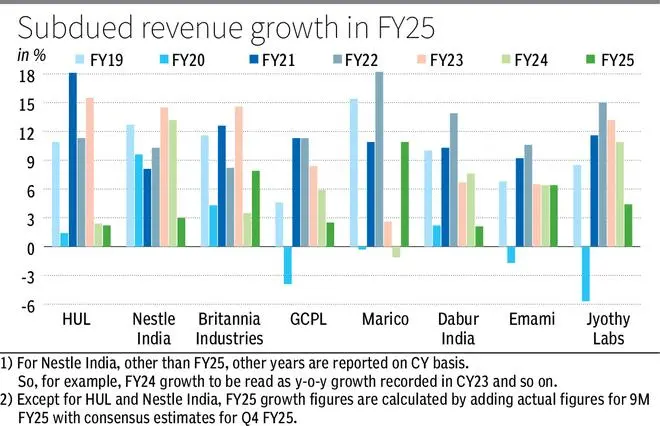

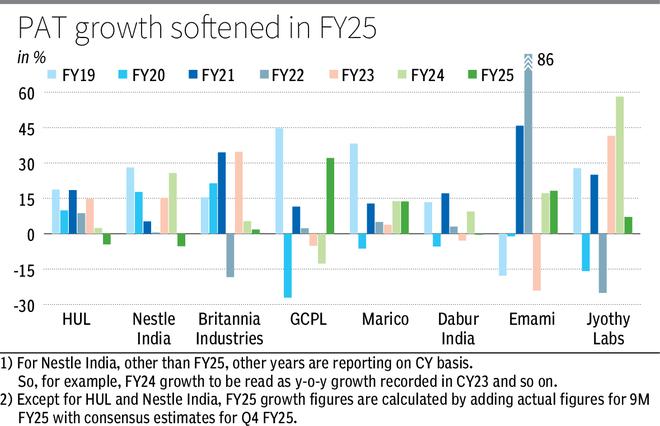

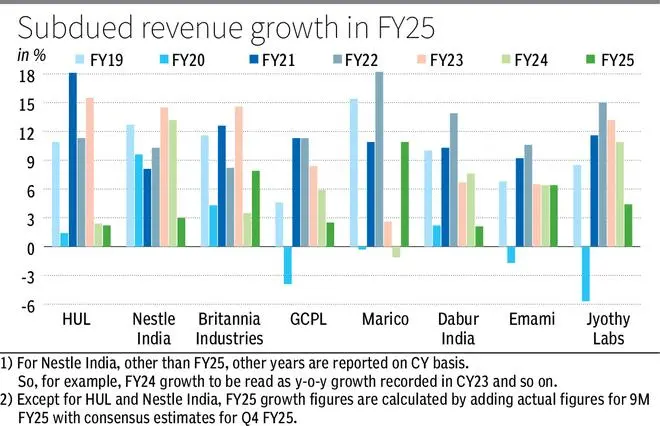

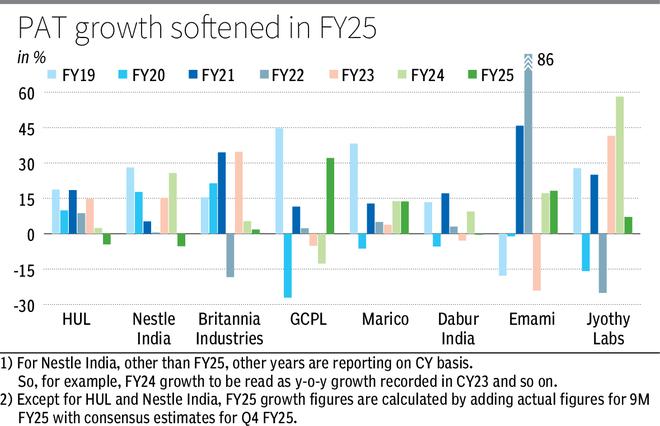

HUL, Nestle India, Britannia, Godrej Consumer Products, Marico, Dabur, Emami, Jyothy Labs et al: What’s weighing on the FMCG sector and is demand recovery in sight?

HUL, at 48.8 times its FY26 earnings, despite its market leadership and a discount to its five-year average, might see further deterioration with cut in margin guidance by 100 bps to 22-23 per cent for FY26. Its average volume growth from FY20 stands at 3 per cent, half that of the 7 per cent growth recorded during FY11-19. Dabur, with challenges in pushing sales through general trade might also see a difficult FY26, and trading at around 42 times its FY26 earnings, margin to safety seems minimal.Emami and Jyothy Labs are relatively cheaper, trading at 29 times and 31.8 times their FY26 earnings respectively. Per our recent recommendations, investors can consider accumulating in these counters.Consequently, Jyothy Labs and GCPL saw their EBITDA margin improve 10 bps and 40 bps year on year during 9M FY25. Emami, with improved offtake in its high-margin antiseptic cream and gels, saw its EBITDA and PAT margins expand 50 bps and 110 bps during 9M FY25.

Consumption blues

Softening raw material prices, particularly copra and palm oil, should help improve profitability going ahead. Also, price hike measures still underway, continuing until Q1 FY26, hints at price growth for FY26. But sustained increase in advertising and promotion expenses, to drive volume growth, will continue, limiting the expansion in profit margins. The focus continues to be on volume-driven growth and demand environment is expected to improve starting from Q2 FY26.In macro terms, the urban-rural gap in monthly per capita consumption expenditure is down to 70 per cent in 2023-24 from 84 per cent in 2011-12, signalling steady rural consumption growth. For the urban markets, a rise in disposable income, thanks to tax cuts and panel for the eighth pay commission (expected to come into effect from H2 FY26) to be appointed in the next two-three months, alongside a softening inflation is theoretically a positive set-up.However, post this underperformance, and amid global trade-war driven uncertainties, views now are again emerging in favour of FMCG stocks. But has there been a fair reset in the valuation? What’s weighing on the sector, how are companies responding and what does it all mean for long-term investors? Here is a lowdown.After many seasons of erratic monsoon post-Covid, 9M FY25 saw green shoots with better agricultural output. With the advance estimates of wheat production signalling a strong harvest and the current market prices at a premium to the minimum support price, the recovery in the rural markets seems set to continue into FY26. HUL, on the other hand, in a bid to strengthen general trade, has initiated a direct-to-kirana distribution strategy in Mumbai aimed at faster and reliable deliveries helping retailers avoid large inventory holdings.

Distribution conundrum

There is an inevitable structural shift taking place in the distribution channels and the go-to-market strategies. So, slowdown apart, changing dynamics, including D2C players gaining market share, also need to be factored while considering investments in the sector.An alternate line of thought gaining ground is that while a slowdown is observed in the growth trajectory of the listed giants, it is not entirely a result of cyclical economic slowdown and inflation in recent years. Corroboration comes from digital-first direct-to-consumer (D2C) brands, with the right formulations, continuing to grow exponentially (albeit on a low base), despite being skewed towards the urban premium. Food & BeverageWhile general trade still contributes more than half of the sector’s revenue currently, modern trade channels (including online channels) are leading the growth with healthy double-digit, year-on-year gains.Almost the entire FMCG pack forecasted a double-digit volume growth for FY25, at least from H2 FY25, with a gradual recovery in rural, while urban continues its growth trajectory. But what actually played out has been starkly different. While rural markets, which were a drag post Covid, recovered from Q4 FY24, urban markets which carried the mantle until FY24 are underperforming now.There were times when players in the industry could flex their muscles stating their huge network of distributors and kirana store retailers. HUL’s EBITDA margins were down 21 bps for FY25, while that of Marico and Dabur also dropped 70 bps and 74 bps during 9M FY25, owing to inflation in prices of palm oil, copra and fruit concentrates respectively, their key raw materials. But now some of the above factors have taken a hit. Recent years have shown that volume and earnings growth may not be consistent, and global liquidity has significantly tightened. Zero or ultra-low interest rates in developed markets meant that an FMCG stock priced at 75 times its earnings could even be attractive for a foreign investor. This is not the case anymore, with risk-free government bonds in developed markets giving attractive yields relative to high-PE FMCG stocks. So the levers for premium valuation are waning. Home & Personal CareThe recent financial performance of players, part of the FMCG index and also under our coverage, validate the evolving demand trends and shifts in margin dynamics across the sector.Home and Personal care segment continued to be the largest and fastest growing segment for HUL and Dabur.

Momentum check

But disruption has come via quick commerce (q-commerce). Though e-commerce was already in the fray, the real disruption was brought about by q-commerce, being the real alternative to the kirana stores, meeting your last-minute needs.Improved product mix helped Emami, Jyothy Labs and Godrej Consumer Products (GCPL) with their profit margins. The growth and increased penetration in high-margin liquid detergents also helped Jyothy Labs and GCPL with their profitability.To address some of the challenges here, the industry giants have warmed up to acquisitions. With healthy cash generation every year, the M&A playbook has always been integral to the incumbents. Acquiring emerging D2C brands, apart from adding to the product portfolio, has also helped expand their digital presence.Q-commerce has diluted the significance of a distribution network. Minimal investments in distribution networks meant that the focus could be channelled towards new product development and promotions. A rising quality-consciousness among consumers further levelled the field and D2C brands, with the right formulation and a focus on ingredient composition, have managed to score big. Earning brand loyalty, consequently, is more difficult now than it ever has been. This is where the sector giants are facing competition from emerging players. But the last five years tell a totally different story with Nifty FMCG index returning just 95 per cent, while Nifty 50 zoomed 159 per cent. Industry leaders like HUL and Nestle India even underperformed the sectoral index, returning a meagre 0.5 per cent and 34.5 per cent during the same period.The scale-up pace will be a key monitorable here.At the start of 2010, the Nifty FMCG index was valued at 30 times its earnings. The decade that followed (2010-19) saw earnings grow at a 13.6 per cent CAGR, while the index grew at a significantly higher CAGR of 17.1 per cent, stretching the valuation to 40 times its earnings, as at the end of 2019. While a burgeoning middle-income group drove business and earnings growth, the valuation re-rating was driven by low global interest rates and liquidity gush. Besides, investor confidence in consistency of earnings growth with most companies in the sector regarded as quality stocks, backed by a strong track record of execution and sound corporate governance added fuel. Also, the capex cycle taking a hit due to the bank clean-up during the decade meant that consumer non-discretionary plays were relatively better bets. However, urban markets are seeing premiumisation as a key trend with mass-market products, which drive the bulk of FMCG business, underperforming. And interestingly, many companies saw small packs flying off the shelves faster in Q3 FY25, which could be a sign of distress.

Outlook

Published on April 26, 2025 The Nifty FMCG index has corrected from a peak PE of 52.8 times in January 2024 to 44.3 times now. But it is still at a premium to its five-year average of 42.6 times. The pre-Covid five-year average PE is at a much lower 40.2 times, signalling that the correction might be underdone. However, these acquisitions were, more often than not, worked out at steep valuations and do not materially add to the acquirers’ topline immediately. For example, HUL’s acquisition of The Minimalist was valued at an expensive 8.5 times its FY24 revenue of ₹347 crore. But it only adds around 0.6 per cent to HUL’s FY25 revenue.

Valuation

The industry will continue to grow, but the pace at which it comes is the million-dollar-question. For the near term, changing dynamics in the distribution channels might have an impact, but in the long term, premiumisation is expected to continue being the driving factor with a focus on the product portfolio. Under-penetrated categories such as body wash liquids, functional nutritional drinks, household insecticides, oral care and hair care products could drive faster growth for Emami, Jyothy Labs, GCPL and Marico.High valuation multiples always work against share appreciation unless growth is consistent. All hinges on volume growth recovery for the industry. And at this juncture, valuation is the most critical factor for investors to find investment opportunities in this sector. Hence, tempered expectations and selective stock-picking should be the way to go.

HUL, looking to expand its offerings under the beauty and wellbeing (B&WB) segment, bought out The Minimalist in Q3 FY25. Emami, meanwhile, acquired The Man Company and Brillare Sciences, operating in the same B&WB segment. Marico, too, acquired four D2C companies – Beardo, True Elements, Just Herbs and Plix.In the earlier structure, emerging brands were stonewalled by the distribution network, but now they can compete better. And the D2C/emerging brands have turned out to be the quiet, industrious ants to the elephant-esque legacy players.While globally, FMCG/ consumer non-discretionary sectors are viewed as defensive plays, in India, for over a decade, they also served as aggressive growth bets. Why not, when GDP was growing consistently in mid- to high-single digits pulling up millions of people out of poverty and pushing them into the consumption class! On top of this, a rising affluent middle-class drove increased demand. The theme played out so well between 2010 and 2019 with Nifty FMCG index delivering 263 per cent, significantly outperforming Nifty 50 which delivered 128 per cent. HUL and Nestle India were bumper hits during this period, returning 515 per cent and 288 per cent respectively. Nestle India continues to be the most expensive, trading at 68.7 times. Marico, trading at 50.6 times its FY26 earnings, is still at a 14 per cent premium to its five-year average, leaving little room to err. Similarly, Britannia is trading at an 11 per cent premium to its five-year average and GCPL at a premium of 19 per cent. With the urban distribution channels disrupted by q-commerce, the companies have started consolidating their urban outreach, focusing on ‘high-potential outlets’, while continuing to expand their rural outreach. Companies are now even tailoring SKUs by channel to spur growth.Both Britannia and Nestle India undertook price hikes to protect their margins on account of sustained inflation in input costs. But having been late to pass on the rising input prices, despite the volume growth of around 6-8 per cent year on year during 9M FY25, Britannia’s revenue grew just 4.6 per cent. Though marginally better than FY24’s 3.5 per cent and FY20’s 4.3 per cent, it is the slowest since FY03. EBITDA margin was down 100 basis points (bps). Nestle India, similarly, found its EBITDA margin down 59 bps, while revenue grew just 3 per cent (its lowest since FY16), resulting in EBITDA being flat.

There were times when players in the industry could flex their muscles stating their huge network of distributors and kirana store retailers. However, these acquisitions were, more often than not, worked out at steep valuations and do not materially add to the acquirers’ topline immediately. For example, HUL’s acquisition of The Minimalist was valued at an expensive 8.5 times its FY24 revenue of ₹347 crore. But it only adds around 0.6 per cent to HUL’s FY25 revenue. The scale-up pace will be a key monitorable here.

Consumption blues

While general trade still contributes more than half of the sector’s revenue currently, modern trade channels (including online channels) are leading the growth with healthy double-digit, year-on-year gains.Consequently, Jyothy Labs and GCPL saw their EBITDA margin improve 10 bps and 40 bps year on year during 9M FY25. Emami, with improved offtake in its high-margin antiseptic cream and gels, saw its EBITDA and PAT margins expand 50 bps and 110 bps during 9M FY25.High valuation multiples always work against share appreciation unless growth is consistent. All hinges on volume growth recovery for the industry. And at this juncture, valuation is the most critical factor for investors to find investment opportunities in this sector. Hence, tempered expectations and selective stock-picking should be the way to go.HUL, on the other hand, in a bid to strengthen general trade, has initiated a direct-to-kirana distribution strategy in Mumbai aimed at faster and reliable deliveries helping retailers avoid large inventory holdings.Q-commerce has diluted the significance of a distribution network. Minimal investments in distribution networks meant that the focus could be channelled towards new product development and promotions. A rising quality-consciousness among consumers further levelled the field and D2C brands, with the right formulation and a focus on ingredient composition, have managed to score big. Earning brand loyalty, consequently, is more difficult now than it ever has been. This is where the sector giants are facing competition from emerging players.

Distribution conundrum

Almost the entire FMCG pack forecasted a double-digit volume growth for FY25, at least from H2 FY25, with a gradual recovery in rural, while urban continues its growth trajectory. But what actually played out has been starkly different. While rural markets, which were a drag post Covid, recovered from Q4 FY24, urban markets which carried the mantle until FY24 are underperforming now.HUL, looking to expand its offerings under the beauty and wellbeing (B&WB) segment, bought out The Minimalist in Q3 FY25. Emami, meanwhile, acquired The Man Company and Brillare Sciences, operating in the same B&WB segment. Marico, too, acquired four D2C companies – Beardo, True Elements, Just Herbs and Plix.HUL’s EBITDA margins were down 21 bps for FY25, while that of Marico and Dabur also dropped 70 bps and 74 bps during 9M FY25, owing to inflation in prices of palm oil, copra and fruit concentrates respectively, their key raw materials. Food & BeverageThe industry will continue to grow, but the pace at which it comes is the million-dollar-question. For the near term, changing dynamics in the distribution channels might have an impact, but in the long term, premiumisation is expected to continue being the driving factor with a focus on the product portfolio. Under-penetrated categories such as body wash liquids, functional nutritional drinks, household insecticides, oral care and hair care products could drive faster growth for Emami, Jyothy Labs, GCPL and Marico.The Nifty FMCG index has corrected from a peak PE of 52.8 times in January 2024 to 44.3 times now. But it is still at a premium to its five-year average of 42.6 times. The pre-Covid five-year average PE is at a much lower 40.2 times, signalling that the correction might be underdone. In macro terms, the urban-rural gap in monthly per capita consumption expenditure is down to 70 per cent in 2023-24 from 84 per cent in 2011-12, signalling steady rural consumption growth. For the urban markets, a rise in disposable income, thanks to tax cuts and panel for the eighth pay commission (expected to come into effect from H2 FY26) to be appointed in the next two-three months, alongside a softening inflation is theoretically a positive set-up.Home and Personal care segment continued to be the largest and fastest growing segment for HUL and Dabur.While globally, FMCG/ consumer non-discretionary sectors are viewed as defensive plays, in India, for over a decade, they also served as aggressive growth bets. Why not, when GDP was growing consistently in mid- to high-single digits pulling up millions of people out of poverty and pushing them into the consumption class! On top of this, a rising affluent middle-class drove increased demand. The theme played out so well between 2010 and 2019 with Nifty FMCG index delivering 263 per cent, significantly outperforming Nifty 50 which delivered 128 per cent. HUL and Nestle India were bumper hits during this period, returning 515 per cent and 288 per cent respectively. Nestle India continues to be the most expensive, trading at 68.7 times. Marico, trading at 50.6 times its FY26 earnings, is still at a 14 per cent premium to its five-year average, leaving little room to err. Similarly, Britannia is trading at an 11 per cent premium to its five-year average and GCPL at a premium of 19 per cent. After many seasons of erratic monsoon post-Covid, 9M FY25 saw green shoots with better agricultural output. With the advance estimates of wheat production signalling a strong harvest and the current market prices at a premium to the minimum support price, the recovery in the rural markets seems set to continue into FY26.

Momentum check

However, urban markets are seeing premiumisation as a key trend with mass-market products, which drive the bulk of FMCG business, underperforming. And interestingly, many companies saw small packs flying off the shelves faster in Q3 FY25, which could be a sign of distress. Both Britannia and Nestle India undertook price hikes to protect their margins on account of sustained inflation in input costs. But having been late to pass on the rising input prices, despite the volume growth of around 6-8 per cent year on year during 9M FY25, Britannia’s revenue grew just 4.6 per cent. Though marginally better than FY24’s 3.5 per cent and FY20’s 4.3 per cent, it is the slowest since FY03. EBITDA margin was down 100 basis points (bps). Nestle India, similarly, found its EBITDA margin down 59 bps, while revenue grew just 3 per cent (its lowest since FY16), resulting in EBITDA being flat. The recent financial performance of players, part of the FMCG index and also under our coverage, validate the evolving demand trends and shifts in margin dynamics across the sector.But the last five years tell a totally different story with Nifty FMCG index returning just 95 per cent, while Nifty 50 zoomed 159 per cent. Industry leaders like HUL and Nestle India even underperformed the sectoral index, returning a meagre 0.5 per cent and 34.5 per cent during the same period.At the start of 2010, the Nifty FMCG index was valued at 30 times its earnings. The decade that followed (2010-19) saw earnings grow at a 13.6 per cent CAGR, while the index grew at a significantly higher CAGR of 17.1 per cent, stretching the valuation to 40 times its earnings, as at the end of 2019. While a burgeoning middle-income group drove business and earnings growth, the valuation re-rating was driven by low global interest rates and liquidity gush. Besides, investor confidence in consistency of earnings growth with most companies in the sector regarded as quality stocks, backed by a strong track record of execution and sound corporate governance added fuel. Also, the capex cycle taking a hit due to the bank clean-up during the decade meant that consumer non-discretionary plays were relatively better bets. Improved product mix helped Emami, Jyothy Labs and Godrej Consumer Products (GCPL) with their profit margins. The growth and increased penetration in high-margin liquid detergents also helped Jyothy Labs and GCPL with their profitability.But disruption has come via quick commerce (q-commerce). Though e-commerce was already in the fray, the real disruption was brought about by q-commerce, being the real alternative to the kirana stores, meeting your last-minute needs.With the urban distribution channels disrupted by q-commerce, the companies have started consolidating their urban outreach, focusing on ‘high-potential outlets’, while continuing to expand their rural outreach. Companies are now even tailoring SKUs by channel to spur growth.

Outlook

Published on April 26, 2025 In the earlier structure, emerging brands were stonewalled by the distribution network, but now they can compete better. And the D2C/emerging brands have turned out to be the quiet, industrious ants to the elephant-esque legacy players.However, post this underperformance, and amid global trade-war driven uncertainties, views now are again emerging in favour of FMCG stocks. But has there been a fair reset in the valuation? What’s weighing on the sector, how are companies responding and what does it all mean for long-term investors? Here is a lowdown.

Valuation

Softening raw material prices, particularly copra and palm oil, should help improve profitability going ahead. Also, price hike measures still underway, continuing until Q1 FY26, hints at price growth for FY26. But sustained increase in advertising and promotion expenses, to drive volume growth, will continue, limiting the expansion in profit margins. The focus continues to be on volume-driven growth and demand environment is expected to improve starting from Q2 FY26.There is an inevitable structural shift taking place in the distribution channels and the go-to-market strategies. So, slowdown apart, changing dynamics, including D2C players gaining market share, also need to be factored while considering investments in the sector.

But now some of the above factors have taken a hit. Recent years have shown that volume and earnings growth may not be consistent, and global liquidity has significantly tightened. Zero or ultra-low interest rates in developed markets meant that an FMCG stock priced at 75 times its earnings could even be attractive for a foreign investor. This is not the case anymore, with risk-free government bonds in developed markets giving attractive yields relative to high-PE FMCG stocks. So the levers for premium valuation are waning. An alternate line of thought gaining ground is that while a slowdown is observed in the growth trajectory of the listed giants, it is not entirely a result of cyclical economic slowdown and inflation in recent years. Corroboration comes from digital-first direct-to-consumer (D2C) brands, with the right formulations, continuing to grow exponentially (albeit on a low base), despite being skewed towards the urban premium. To address some of the challenges here, the industry giants have warmed up to acquisitions. With healthy cash generation every year, the M&A playbook has always been integral to the incumbents. Acquiring emerging D2C brands, apart from adding to the product portfolio, has also helped expand their digital presence.Home & Personal CareHUL, at 48.8 times its FY26 earnings, despite its market leadership and a discount to its five-year average, might see further deterioration with cut in margin guidance by 100 bps to 22-23 per cent for FY26. Its average volume growth from FY20 stands at 3 per cent, half that of the 7 per cent growth recorded during FY11-19. Dabur, with challenges in pushing sales through general trade might also see a difficult FY26, and trading at around 42 times its FY26 earnings, margin to safety seems minimal.Emami and Jyothy Labs are relatively cheaper, trading at 29 times and 31.8 times their FY26 earnings respectively. Per our recent recommendations, investors can consider accumulating in these counters.

Business

Wisconsin judge arrested for aiding immigration evasion; DOJ charges obstruction

Hannah Dugan, a Milwaukee County circuit judge

| Photo Credit:

MIKE DE SISTI/Reuters

A spokesperson for the U.S. Marshals Service said Dugan was arrested at the courthouse where she works on Friday morning. She was due to appear in federal court in Milwaukee later on Friday. A crowd formed outside the courthouse, chanting “free the judge now.”Wisconsin court records show that a man by that name who faced misdemeanor battery charges related to domestic abuse appeared in Dugan’s courtroom on April 18.According to the complaint, Dugan became “visibly angry” and commented that the situation was “absurd” when she discovered that immigration officials were there to arrest Flores-Ruiz.The arrest comes as the Justice Department has directed federal prosecutors to pursue criminal cases against local government officials who interfere with the administration’s immigration crackdown. Such resistance was widespread during Trump’s first 2017-2021 term in office.Dugan ordered the immigration officials to go and speak with the chief judge and then escorted Flores-Ruiz and his attorney through a door which led to a non-public area of the courthouse, the complaint said.A spokesperson for the FBI could not be immediately reached for comment.FBI Director Kash Patel said on social media that the FBI had arrested Dugan for interfering with the attempted arrest of Eduardo Flores-Ruiz, whom he described as an “illegal alien” now in custody. He later deleted that post, which he made before the case against Dugan was unsealed in federal court.In a criminal complaint, the U.S. Justice Department said Hannah Dugan, a Milwaukee County circuit judge, refused to turn over the man after immigration agents showed up to arrest him in her courtroom on April 18, and that she tried to help him evade arrest by allowing him to exit through a jury door.

-

india2 years ago

india2 years ago“Major Crash of Sukhoi Su-30 and Mirage 2000 Fighter Jets in Madhya Pradesh”

-

Sports2 years ago

Sports2 years agoWFI meetings on April 16, elections likely to be discussed

-

india1 year ago

india1 year agoPM Modi Meets Deve Gowda for Seat Sharing Talks

-

india1 year ago

india1 year agoBengaluru: False threat to bomb Raj Bhavan

-

india2 years ago

india2 years ago“AIMIM to Contest 50 Seats in Upcoming Telangana Assembly Elections”

-

Entertainment1 year ago

Entertainment1 year agoAnant Ambani: Controversy at the Ambani Pre-Wedding Bash

-

Karnataka2 years ago

Karnataka2 years agoWomen have to show their Aadhaar to travel free on KSRTC bus

-

Entertainment2 years ago

Entertainment2 years agoRajinikanth is Moideen Bhai in ‘Lal Salaam’