Business

Malaysia Airlines Eyes Partnerships, May Revisit Cathay Pacific Plans

Explore Malaysia Airlines’ plans for joint business agreements with carriers and the potential revival of its partnership with Cathay Pacific.

Malaysia Airlines is engaged in discussions with three carriers to establish joint business agreements (JBAs), with a potential resurgence of plans for a partnership with Cathay Pacific on the horizon.

Malaysia Airlines

Captain Izham Ismail, Managing Director of Malaysia Airlines and Malaysia Aviation Group (MAG), revealed the airline’s aspirations to develop multiple JBAs akin to its existing collaboration with Japan Airlines (JAL) within the Oneworld alliance.

Initially, Malaysia Airlines had sought to launch a joint business with Cathay Pacific, operating on a metal-neutral basis for flights connecting Hong Kong and Malaysia. However, these plans were shelved last year following an investigation by Hong Kong’s Competition Commission.

In a recent interview on the Window Seat podcast during Routes Asia 2024, Izham expressed ongoing discussions with three other carriers regarding joint business ventures. He emphasized the importance of JBAs as a strategic pillar for the airline’s future growth.

While remaining tight-lipped about the identity of the carriers involved, Izham hinted at a potentially aggressive approach to modeling joint businesses in the future. He also hinted at the possibility of revisiting the partnership with Cathay Pacific within the next 12 to 24 months.

The partnership between Malaysia Airlines and Japan Airlines commenced in July 2020, facilitating codeshares between Malaysia and Japan, including domestic flights. However, the collaboration with Cathay Pacific, announced in early 2022, faced regulatory scrutiny in Hong Kong.

Following an investigation by Hong Kong’s competition regulator, concerns were raised about potential violations of competition laws. Consequently, both airlines opted to withdraw their proposals, with the Competition Commission closing its inquiry in September.

Despite the setback with Cathay Pacific, Malaysia Airlines remains committed to expanding its international network through strategic partnerships. The ongoing discussions with multiple carriers underscore the airline’s determination to strengthen its position in the global market.

As Malaysia Airlines explores opportunities for collaboration, the revival of plans with Cathay Pacific presents a potential avenue for enhancing connectivity between Malaysia and key international destinations. With JBAs at the forefront of its business strategy, Malaysia Airlines aims to navigate the evolving aviation landscape with resilience and adaptability.

Business

Why India’s hotels enjoy highest EV per room globally

In contrast, global hospitality giants with far larger portfolios and stronger international brand equity trade at significantly lower EV/room figures. US-listed Marriott International, which manages over 5.8 lakh rooms globally, has an EV/room of ₹1.25 crore. Similarly, Hilton Worldwide stands at ₹2.17 crore. UK’s InterContinental Hotels Group has an EV/room of less than ₹20 lakh. France’s Accor is even lower at ₹14 lakh. China’s H World Group has an EV/room of less than ₹10 lakh.Mid-tier hospitality stocks in Indian listed space have participated too. Chalet Hotels is up 46 per cent in three years. Lemon Tree Hotels has gained 33 per cent, while Royal Orchid has delivered 44 per cent. So why are India’s hotel valuations per room so elevated?First, Indian hotel companies continue to own a large portion of their inventory, unlike their global peers which primarily operate under asset-light franchise or management contracts. Owning land and buildings, especially in high-value city-centre locations, results in far higher capital intensity. This drives up the cost, even if the actual room count remains modest. For instance, IHCL has nearly 26,500 rooms, a fraction of what Marriott or Accor own or manage globally.

On a high

Published on May 31, 2025 Back in India, signs of a shift are visible. Firms like IHCL, EIH, and ITC Hotels are actively moving towards an asset-light strategy to drive future expansion. New projects are increasingly management or franchise-led. For instance, 15,900 of the new 19,500 IHCL rooms to be added will be under management contract. If this continues, India’s per-room valuation metrics may start converging with global benchmarks over time.India’s hotel sector is hogging the headlines with the country witnessing its largest-ever hospitality IPO. Brookfield-backed Schloss Bangalore, owner of The Leela hotels, recently mopped up ₹3,500 crore.Tata Group-owned The Indian Hotels Company (IHCL), the country’s largest listed hotel player, commands an EV/room of ₹4.06 crore. EIH, operator of the Oberoi chain, stands at ₹5.3 crore. Soon-to-be listed Schloss Bangalore, which operates at the very top-end of luxury hotels, has an EV/room of over ₹5 crore.

Asset-light models

Two, optimistic growth expectations are already baked into these valuations. Investors are assigning a premium to Indian hotel stocks on the back of improving domestic tourism, higher room rates and occupancy and global travellers returning to India post-pandemic. With relatively younger hotel chains and room portfolios that are still expanding, Indian stocks are being priced for future potential.Interestingly, the strong valuations haven’t come on the back of heavy borrowing. Most of the top listed Indian hotel firms today have low debt on their books. Instead, enterprise value which is the sum of market capitalisation and the net debt on the balance- sheet has expanded largely due to rising market capitalisation in the post-Covid rally. Around 80 per cent of listed Indian hotels stocks have beaten Sensex’s 14 per cent three-year CAGR.Over the last three years, top players have delivered handsome returns. EIH and IHCL stocks have grown at a CAGR of 42 and 51 per cent in last three years. In comparison, 3-year stock returns of global hotels like InterContinental (22.4 per cent CAGR), Hilton Worldwide (20.4 per cent CAGR), Marriott International (15.2 per cent CAGR) and Hyatt Hotels (14.3 per cent CAGR) reflect more modest gains. Compare this with global peers where hotel majors like Marriott, Hilton, and Accor have shifted almost entirely to a franchise-plus-management model. This approach keeps debt and capital expenditure off their books, helping scale rapidly without bloating their balance-sheets. As a result, their enterprise value reflects fee-based income, not real-estate holdings, which naturally brings down EV/room metrics. But this doesn’t necessarily signal under-valuation, it reflects the difference in business models.A look at trailing EV/EBITDA further underlines India’s valuation premium. Indian Hotels trades at 40 times, Chalet at 30.4, and Lemon Tree at 24.1 and Schloss Bangalore at 23. In comparison, Marriott stands at 19.9 times, Accor at 12.8, and Las Vegas Sands at just 11. Hilton is the only outlier at 27.8 times. While the premium valuation is partly explained by more owned assets, for it to sustain the Indian hotel stocks will need to deliver without any glitches on the strong growth expectations as well.But there’s a bigger story brewing underneath: India’s top listed hotel companies now enjoy the highest enterprise value (EV) per room in the world. Take a closer look at the numbers.

Back in India, signs of a shift are visible. Firms like IHCL, EIH, and ITC Hotels are actively moving towards an asset-light strategy to drive future expansion. New projects are increasingly management or franchise-led. For instance, 15,900 of the new 19,500 IHCL rooms to be added will be under management contract. If this continues, India’s per-room valuation metrics may start converging with global benchmarks over time.Published on May 31, 2025 In contrast, global hospitality giants with far larger portfolios and stronger international brand equity trade at significantly lower EV/room figures. US-listed Marriott International, which manages over 5.8 lakh rooms globally, has an EV/room of ₹1.25 crore. Similarly, Hilton Worldwide stands at ₹2.17 crore. UK’s InterContinental Hotels Group has an EV/room of less than ₹20 lakh. France’s Accor is even lower at ₹14 lakh. China’s H World Group has an EV/room of less than ₹10 lakh.So why are India’s hotel valuations per room so elevated?

On a high

But there’s a bigger story brewing underneath: India’s top listed hotel companies now enjoy the highest enterprise value (EV) per room in the world. Take a closer look at the numbers.India’s hotel sector is hogging the headlines with the country witnessing its largest-ever hospitality IPO. Brookfield-backed Schloss Bangalore, owner of The Leela hotels, recently mopped up ₹3,500 crore.Over the last three years, top players have delivered handsome returns. EIH and IHCL stocks have grown at a CAGR of 42 and 51 per cent in last three years. In comparison, 3-year stock returns of global hotels like InterContinental (22.4 per cent CAGR), Hilton Worldwide (20.4 per cent CAGR), Marriott International (15.2 per cent CAGR) and Hyatt Hotels (14.3 per cent CAGR) reflect more modest gains. Mid-tier hospitality stocks in Indian listed space have participated too. Chalet Hotels is up 46 per cent in three years. Lemon Tree Hotels has gained 33 per cent, while Royal Orchid has delivered 44 per cent.

Asset-light models

A look at trailing EV/EBITDA further underlines India’s valuation premium. Indian Hotels trades at 40 times, Chalet at 30.4, and Lemon Tree at 24.1 and Schloss Bangalore at 23. In comparison, Marriott stands at 19.9 times, Accor at 12.8, and Las Vegas Sands at just 11. Hilton is the only outlier at 27.8 times. While the premium valuation is partly explained by more owned assets, for it to sustain the Indian hotel stocks will need to deliver without any glitches on the strong growth expectations as well.Tata Group-owned The Indian Hotels Company (IHCL), the country’s largest listed hotel player, commands an EV/room of ₹4.06 crore. EIH, operator of the Oberoi chain, stands at ₹5.3 crore. Soon-to-be listed Schloss Bangalore, which operates at the very top-end of luxury hotels, has an EV/room of over ₹5 crore.Two, optimistic growth expectations are already baked into these valuations. Investors are assigning a premium to Indian hotel stocks on the back of improving domestic tourism, higher room rates and occupancy and global travellers returning to India post-pandemic. With relatively younger hotel chains and room portfolios that are still expanding, Indian stocks are being priced for future potential.Compare this with global peers where hotel majors like Marriott, Hilton, and Accor have shifted almost entirely to a franchise-plus-management model. This approach keeps debt and capital expenditure off their books, helping scale rapidly without bloating their balance-sheets. As a result, their enterprise value reflects fee-based income, not real-estate holdings, which naturally brings down EV/room metrics. But this doesn’t necessarily signal under-valuation, it reflects the difference in business models.Interestingly, the strong valuations haven’t come on the back of heavy borrowing. Most of the top listed Indian hotel firms today have low debt on their books. Instead, enterprise value which is the sum of market capitalisation and the net debt on the balance- sheet has expanded largely due to rising market capitalisation in the post-Covid rally. Around 80 per cent of listed Indian hotels stocks have beaten Sensex’s 14 per cent three-year CAGR.First, Indian hotel companies continue to own a large portion of their inventory, unlike their global peers which primarily operate under asset-light franchise or management contracts. Owning land and buildings, especially in high-value city-centre locations, results in far higher capital intensity. This drives up the cost, even if the actual room count remains modest. For instance, IHCL has nearly 26,500 rooms, a fraction of what Marriott or Accor own or manage globally.

Business

India cuts customs duty on crude edible oils to 16.5%, extends duty-free import of yellow peas

Indian Vegetable Oils Producer Association President Sudhakar Desai said edible oil processors had been seeking an increase in the duty differential as prime palm oil-producing countries such as Malaysia and Indonesia were subsidising exports of refined, bleached and deodorised (RBD) palm oil and palmolien. A trade expert said the duty-free import will favour Russia and Canada, while pulses import could rise further from the record 6.63 million tonnes in 2023-24. The SEA president said the cost and freight price of RBD palmolien is approximately –50 per tonne lower than CPO. It encourage refined imports at the cost of domestic value addition.

Effective duty

The other feature of Friday’s order is that the relief that countries such as Nepal got through the South Asian Free Trade Agreement will be reduced. Nepal had a 35 per cent duty advantage due to which at least an additional one million tonnes of palm oil was being exported to India.The Solvent Extractors’ Association of India (SEA) said the Government’s decision to increase the duty differential between crude and refined edible oil from 8.25 per cent to 19.25 per cent will help create a level-playing field for domestic refiners and contribute to stabilising edible oil prices for Indian consumers.Published on May 30, 2025 Desai said it will help growers, too, as it would curb imports of refined palm oil, in particular.

Growers to benefit

The duty on refined cooking oils – palm, soya, rapeseed and sunflower -is 32.5 per cent, with the 10 per cent social welfare cess making the effective duty 35.75 per cent. “We were asking for a 20 per cent duty differential. After today’s revision, the differential is 19.25 per cent. We will take this,” said Desai. “That duty advantage has been cut to some extent. It will help the industry,” the IVPA President said.

Aiding refiners

A gazette notification said the duty cut will come into effect from May 31 (Saturday). The edible oil sector has welcomed the duty cut since it widens the duty differential between crude and edible cooking oils to 19.25 per cent. From May 31, crude edible oils – palm, soya, rapeseed and sunflower – will attract a basic Customs duty of 10 per cent, 5 per cent agri cess, 10 per cent social welfare cess, taking the effective duty to 16.5 per cent. Asthana said this trend has been exacerbated by the export policies of supplier countries, which impose higher export duties on CPO (raw material) and lower duties on refined palmolien (finished goods). India imports a significant volume of palm oil, primarily from Indonesia and Malaysia. Historically, Indian refiners have imported CPO, and substantial investments have been made in port-based palm oil refining infrastructure to meet the growing domestic demand for palmolien. Importing CPO enables value addition within the country and supports employment generation in the refining sector, said Asthana.

Trade upset on yellow peas move

As a result of these subsidies over the past year, imports of RBD increased to 35 per cent of total palm oil imports. Sanjeev Asthana, SEA President, said it will discourage imports of refined palmolien and shift demand back to crude palm oil (CPO). It will revitalise the domestic refining sector. “This move will not impact the overall volume of edible oil imports and is unlikely to cause any upward pressure on edible oil prices,” he said. The Indian government late on Friday cut the import duty on crude edible oils such as palm, soyabean and sunflower oil to 16.5 per cent overall from 27.5 per cent. However, it extended duty-free import of yellow peas until March 31, 2026. On the other hand, the Centre’s decision to permit duty-free import of yellow peas irked the trade. “Yellow peas imports are responsible for the current bearish trend in prices of pulses. This will affect growers too, as they are getting returns below the minimum support price for crops such as chickpeas (chana/gram),” said a trader, without wishing to identify.

The Indian government late on Friday cut the import duty on crude edible oils such as palm, soyabean and sunflower oil to 16.5 per cent overall from 27.5 per cent. However, it extended duty-free import of yellow peas until March 31, 2026. A gazette notification said the duty cut will come into effect from May 31 (Saturday). The edible oil sector has welcomed the duty cut since it widens the duty differential between crude and edible cooking oils to 19.25 per cent. Published on May 30, 2025

Effective duty

On the other hand, the Centre’s decision to permit duty-free import of yellow peas irked the trade. “Yellow peas imports are responsible for the current bearish trend in prices of pulses. This will affect growers too, as they are getting returns below the minimum support price for crops such as chickpeas (chana/gram),” said a trader, without wishing to identify. The Solvent Extractors’ Association of India (SEA) said the Government’s decision to increase the duty differential between crude and refined edible oil from 8.25 per cent to 19.25 per cent will help create a level-playing field for domestic refiners and contribute to stabilising edible oil prices for Indian consumers.Indian Vegetable Oils Producer Association President Sudhakar Desai said edible oil processors had been seeking an increase in the duty differential as prime palm oil-producing countries such as Malaysia and Indonesia were subsidising exports of refined, bleached and deodorised (RBD) palm oil and palmolien. A trade expert said the duty-free import will favour Russia and Canada, while pulses import could rise further from the record 6.63 million tonnes in 2023-24.

Growers to benefit

From May 31, crude edible oils – palm, soya, rapeseed and sunflower – will attract a basic Customs duty of 10 per cent, 5 per cent agri cess, 10 per cent social welfare cess, taking the effective duty to 16.5 per cent. Desai said it will help growers, too, as it would curb imports of refined palm oil, in particular. “That duty advantage has been cut to some extent. It will help the industry,” the IVPA President said.

Aiding refiners

India imports a significant volume of palm oil, primarily from Indonesia and Malaysia. Historically, Indian refiners have imported CPO, and substantial investments have been made in port-based palm oil refining infrastructure to meet the growing domestic demand for palmolien. Importing CPO enables value addition within the country and supports employment generation in the refining sector, said Asthana.The SEA president said the cost and freight price of RBD palmolien is approximately –50 per tonne lower than CPO. It encourage refined imports at the cost of domestic value addition.Asthana said this trend has been exacerbated by the export policies of supplier countries, which impose higher export duties on CPO (raw material) and lower duties on refined palmolien (finished goods). The duty on refined cooking oils – palm, soya, rapeseed and sunflower -is 32.5 per cent, with the 10 per cent social welfare cess making the effective duty 35.75 per cent.

Trade upset on yellow peas move

The other feature of Friday’s order is that the relief that countries such as Nepal got through the South Asian Free Trade Agreement will be reduced. Nepal had a 35 per cent duty advantage due to which at least an additional one million tonnes of palm oil was being exported to India.As a result of these subsidies over the past year, imports of RBD increased to 35 per cent of total palm oil imports. Sanjeev Asthana, SEA President, said it will discourage imports of refined palmolien and shift demand back to crude palm oil (CPO). It will revitalise the domestic refining sector. “This move will not impact the overall volume of edible oil imports and is unlikely to cause any upward pressure on edible oil prices,” he said. “We were asking for a 20 per cent duty differential. After today’s revision, the differential is 19.25 per cent. We will take this,” said Desai.

Business

Wipro announces Innovation Network; launches new 60,000 sq. ft. Innovation Lab in Bengaluru

Wipro Innovation Network

Wipro has announced the launch of its global Wipro Innovation Network designed to accelerate strategic, client-centric co-innovation. The network will leverage frontier technologies ranging from AI to Quantum Computing. The company also announced the opening of its newest 60,000 sq. ft. Innovation Lab at its Kodathi campus in Bengaluru.Published on May 29, 2025

The Wipro Innovation Network is said to focus on five strategic frontier technology themes: Agentic AI, robotics with embodied AI, quantum computing, digital ledger technology, and quantum-safe cyber resilience.It will bring together Wipro’s innovation ecosystem, including the Innovation Labs, the Partner Labs, Wipro Ventures, its crowdsourcing platform Topcoder, alliances with leading academic and research institutions, and its deep technology talent to create an ongoing loop of ideation, research and innovation.Companies to follow

Wipro Innovation Network

“At Wipro, we believe that collaboration fuels innovation,” said Srini Pallia, CEO and Managing Director, Wipro Ltd. “The Wipro Innovation Network is a catalyst for AI-powered co-innovation. By bringing together our global clients, partners, academia, and tech communities, we aim to accelerate innovation that solves real-world challenges, unlocks bold new possibilities, and drives competitive edge for our clients.”They can also experience a range of advanced solutions, including agentic systems for software engineering, Smart Factories powered by embodied AI, the Cloud Car, Inspect AI, Wealth AI, Earnings AI, and quantum computing applications for drug discovery, among others. Published on May 29, 2025 Companies to follow

The Wipro Innovation Network is said to focus on five strategic frontier technology themes: Agentic AI, robotics with embodied AI, quantum computing, digital ledger technology, and quantum-safe cyber resilience.

-

india2 years ago

india2 years ago“Major Crash of Sukhoi Su-30 and Mirage 2000 Fighter Jets in Madhya Pradesh”

-

Sports2 years ago

Sports2 years agoWFI meetings on April 16, elections likely to be discussed

-

india1 year ago

india1 year agoPM Modi Meets Deve Gowda for Seat Sharing Talks

-

india1 year ago

india1 year agoBengaluru: False threat to bomb Raj Bhavan

-

india2 years ago

india2 years ago“AIMIM to Contest 50 Seats in Upcoming Telangana Assembly Elections”

-

Entertainment1 year ago

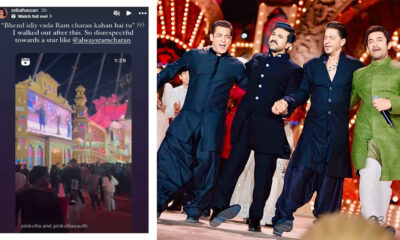

Entertainment1 year agoAnant Ambani: Controversy at the Ambani Pre-Wedding Bash

-

Karnataka2 years ago

Karnataka2 years agoWomen have to show their Aadhaar to travel free on KSRTC bus

-

Entertainment2 years ago

Entertainment2 years agoRajinikanth is Moideen Bhai in ‘Lal Salaam’