Business

Renault opens new car design centre in Chennai

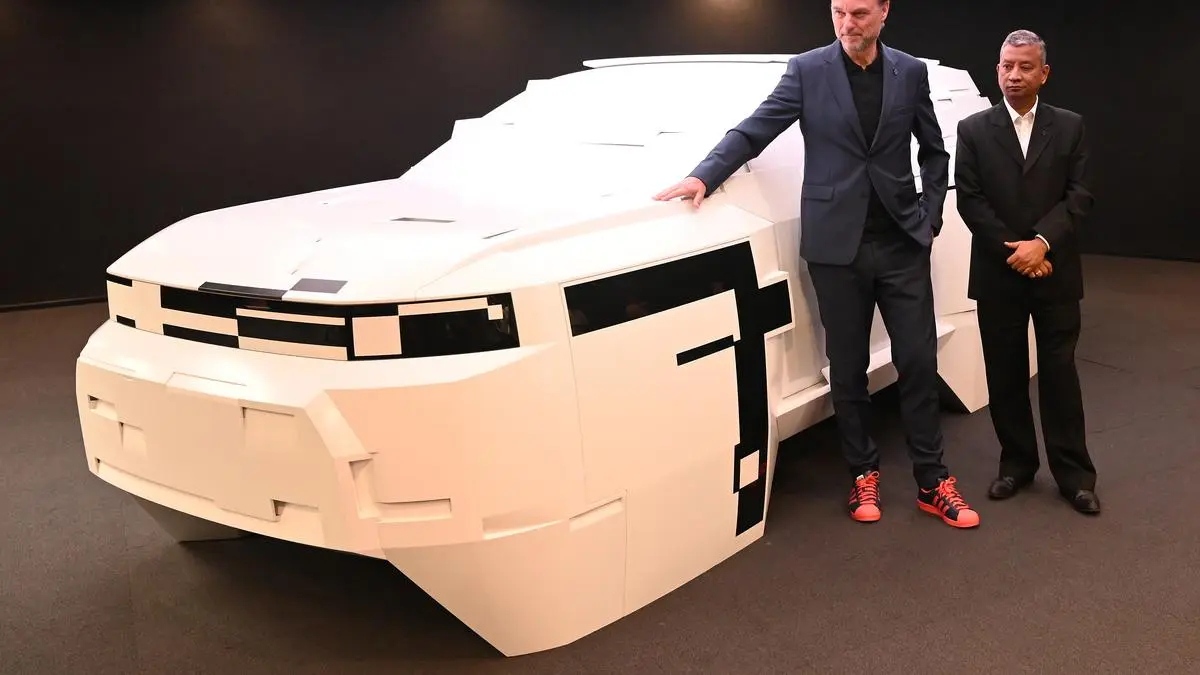

Laurens van den Acker, Chief Design Officer, Renault Group and M Venkatram, Country CEO and MD, Renault India at the unveiling of a sculpture model designed by the Renault Design team, at the Renault Nissan Technology & Business Centre at Mahindra City, near Chennai

| Photo Credit:

BIJOY GHOSH

The company’s design journey in India began with studios in Pune and Mumbai, which have now been consolidated into the new state-of-the-art Chennai facility.Renault already operates one of its largest global R&D centers in Chennai, with nearly 10,000 engineers contributing to both local and international projects. The company also actively exports made-in-India components for use in vehicles manufactured around the world.Published on April 22, 2025 “India is a unique and complex market shaped by local consumer preferences. Establishing a dedicated design studio here is essential to truly understand these dynamics and create relevant solutions,” said Laurens van den Acker, Chief Design Officer, Renault Group. “The Chennai studio will not only focus on India-specific concepts and models but will also contribute to global projects under the Renault Group umbrella.”French automaker Renault has unveiled what it calls its largest design facility outside France, the Renault Design Centre Chennai (RDCC), located within the Renault Nissan Technology & Business Centre India campus at Mahindra City, near Chennai.This new facility will be responsible for designing all five upcoming Renault models set to launch in India over the next two years. The studio currently employs over 30 design professionals.“We are proud to be the most Indian of European carmakers,” Venkatram Mamillapalle, Country CEO and Managing Director of Renault India Operations, said. “From our extensive R&D center to a robust manufacturing footprint and a deeply localized supply chain, Renault has built strong roots in India. The new Chennai design centre adds yet another dimension to this foundation, positioning us to take forward the Renault International Game Plan 2027.”“We are expanding our Indian design team and collaborating closely with stakeholders across the country’s automotive ecosystem,” van den Acker added. “This enables us to deliver products that resonate deeply with Indian consumers while strengthening Renault’s global innovation pipeline.”

Business

R&D services for cancer diagnosis does not qualify for GST exemption as ‘healthcare services’, says Maha AAR

According to Sandeep Sehgal, Partner at AKM Global, the said ruling highlights a crucial distinction between approved healthcare diagnostics and new, tech-driven testing methods. It clearly states that not all laboratory tests are automatically exempt from GST. If a test is still in the experimental stage and lacks approvals from regulatory bodies like ICMR or CDSCO, it will be treated as research and subject to GST. This is a key takeaway for diagnostic start-ups and labs using advanced technologies like genome sequencing or AI-based testing. Therefore, “to qualify for GST exemption under healthcare services, obtaining proper medical licenses and regulatory approvals is essential,” he said.Published on April 21, 2025 “The primary activity is research and experimental development of Cancer Prognostic and Diagnostic Technologies,” MAAR said while ruling that it is not eligible for the benefit of exemption. The quails judicial body observed that diagnostic test is still in its developmental stage and is not yet validated by the medical regulatory bodies. It noticed that applicant has not produced any license or certificate from Central Drugs Standard Control Organisation or any approval from Indian Council for Medical Research . It also said: “Tests cannot be treated as a proper diagnostic test but is more in the nature of clinical research and development and as a result it does not qualify as a Health Care Service.”Epigeneres Biotech Private Ltd had moved MAAR seeking advance ruling on whether the provision of diagnostic services would qualify for exemption from GST. Diagnostic services for conducting blood tests which assists in early detection of cancer fall out of the periphery of ‘Healthcare services’, Maharashtra’s Authority for Advance Ruling (MAAR) has ruled. This means such a service will not be exempted from GST.

“The primary activity is research and experimental development of Cancer Prognostic and Diagnostic Technologies,” MAAR said while ruling that it is not eligible for the benefit of exemption. The quails judicial body observed that diagnostic test is still in its developmental stage and is not yet validated by the medical regulatory bodies. It noticed that applicant has not produced any license or certificate from Central Drugs Standard Control Organisation or any approval from Indian Council for Medical Research . It also said: “Tests cannot be treated as a proper diagnostic test but is more in the nature of clinical research and development and as a result it does not qualify as a Health Care Service.”This is a key takeaway for diagnostic start-ups and labs using advanced technologies like genome sequencing or AI-based testing. Therefore, “to qualify for GST exemption under healthcare services, obtaining proper medical licenses and regulatory approvals is essential,” he said.According to Sandeep Sehgal, Partner at AKM Global, the said ruling highlights a crucial distinction between approved healthcare diagnostics and new, tech-driven testing methods. It clearly states that not all laboratory tests are automatically exempt from GST. If a test is still in the experimental stage and lacks approvals from regulatory bodies like ICMR or CDSCO, it will be treated as research and subject to GST. Epigeneres Biotech Private Ltd had moved MAAR seeking advance ruling on whether the provision of diagnostic services would qualify for exemption from GST. Diagnostic services for conducting blood tests which assists in early detection of cancer fall out of the periphery of ‘Healthcare services’, Maharashtra’s Authority for Advance Ruling (MAAR) has ruled. This means such a service will not be exempted from GST.Published on April 21, 2025

Business

Less than human, more than lab rat

They are using pluripotent stem cells, which are the earliest cells that form and give rise to every other type of cell in the body. From pluripotent stem cells to actual embryos, it is but a hop, as is embryo to fetus. After all, they also have artificial uterus technology to help.Scientists are researching developing bodyoids — they are not there yet, but well on the way.Welcome to the emerging world of ‘bodyoids’.Writing in MIT Technology Review, Carsten T Charlesworth, a postdoctoral fellow at the Institute of Stem Cell Biology and Regenerative Medicine, is all for it. He says it is possible to even build animal bodyoids for, say, work in agricultural fields, replacing sentient animals. Charlesworth does advocate caution, but stresses that “the opportunity is too important to ignore”.So, in the near future, a biotech company can mass-produce human bodies that medical students can dissect and study, pharma companies can inject with drugs and assess their effect, avoiding putting mice and primates through the misery of drug tests.Some may find the idea of bodyoids exciting, others disturbing, raising ethical questions.Come to think of it, if you can grow organs-on-a-chip, why not an entire human body?Imagine this: An adult human body, lying on a table. It is not alive — it never did have ‘life’. But it has all organs functioning — except the brain. It is not sentient; it can never feel pain or pleasure — it is “experientially blank”. A fully lab-grown zombie, produced for scientific experiments, including drug testing.

More Like This

Published on April 20, 2025

Writing in MIT Technology Review, Carsten T Charlesworth, a postdoctoral fellow at the Institute of Stem Cell Biology and Regenerative Medicine, is all for it. He says it is possible to even build animal bodyoids for, say, work in agricultural fields, replacing sentient animals. Charlesworth does advocate caution, but stresses that “the opportunity is too important to ignore”.They are using pluripotent stem cells, which are the earliest cells that form and give rise to every other type of cell in the body. From pluripotent stem cells to actual embryos, it is but a hop, as is embryo to fetus. After all, they also have artificial uterus technology to help.So, in the near future, a biotech company can mass-produce human bodies that medical students can dissect and study, pharma companies can inject with drugs and assess their effect, avoiding putting mice and primates through the misery of drug tests.Come to think of it, if you can grow organs-on-a-chip, why not an entire human body?Scientists are researching developing bodyoids — they are not there yet, but well on the way.Published on April 20, 2025 Welcome to the emerging world of ‘bodyoids’.Imagine this: An adult human body, lying on a table. It is not alive — it never did have ‘life’. But it has all organs functioning — except the brain. It is not sentient; it can never feel pain or pleasure — it is “experientially blank”. A fully lab-grown zombie, produced for scientific experiments, including drug testing.

More Like This

Some may find the idea of bodyoids exciting, others disturbing, raising ethical questions.

Business

Dow Jones, S&P 500, Nasdaq Composite: Equities face a US bond brick wall

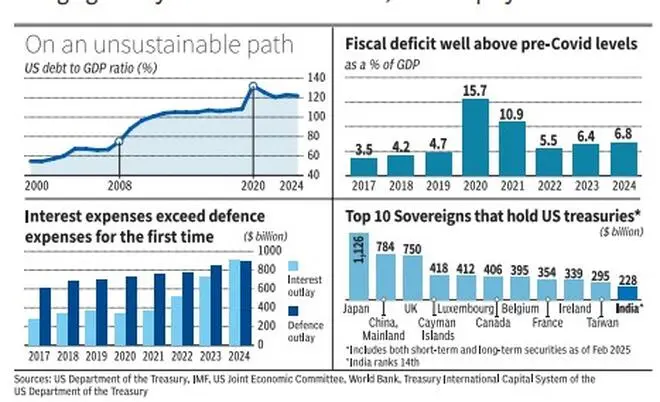

The ‘elephant in the room’ here is the US government’s massive debt pile of .2 trillion. The country has been on a spending spree since the global financial crisis, which accelerated when the Covid pandemic hit.The week before last, US 10-year bonds witnessed the worst week since 2001, with yields spiking 50 basis points over the week to 4.5 per cent. Though yields cooled over the week gone by, a new drama surfaced with a brewing feud between President Trump and Fed Chair Powell.First is the refinancing problem. The previous administration ducked the interest rate pressure by issuing short-term bills instead of long-term bonds. While the approach was unsustainable for long, it’s the current administration’s problem to now refinance them with long-term bonds and will add further pressure on yields.

While the Trump administration is determined to bring yields on long-term bonds down, the Fed’s preference to wait and watch given tariff-led upside risks to inflation is playing a brick wall. Last week, Trump said he couldn’t wait to have Powell’s office terminated, while at the same time Powell’s chairmanship is legally well-guarded. The deadlock is a classic case of when an unstoppable force meets an immovable object.

Three factors

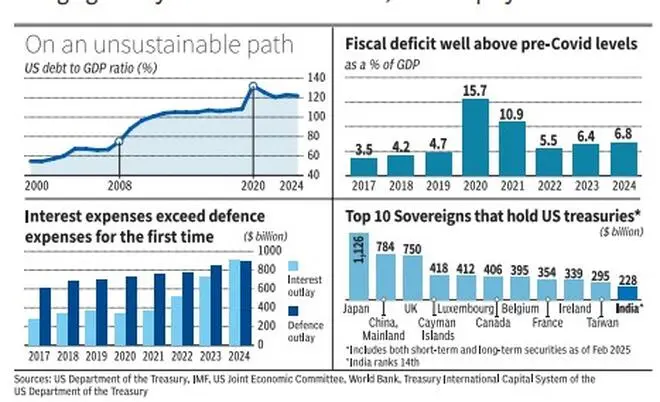

Published on April 19, 2025 Decades earlier, Richard Nixon’s Treasury Secretary famously said: “the dollar is our currency, but it’s your problem”.The debt-related problems for Trump administration stem from three factors.Today, the US’ debt to GDP stands at a significant 122 per cent (December 2024). Bond yields shooting up can burn a hole through the Federal Government’s finances, thus explaining Trump and his administration’s fixation on bond yields. In fact, it was the bond tantrum from the earlier week that pushed Trump to swiftly go slow on reciprocal tariffs.

US debt, an equity woe

The third factor is one that is self-inflicted. The policy of the Trump administration, going back and forth, attempts to upend global supply chains and could tarnish the safe-haven status of US Treasury securities and the global reserve currency status of the dollar. This is where trade war blows up into capital wars. Although there is no strong alternative to the US dollar yet, global central banks might turn to other currencies or gold even more. A week ago, speculations were rife in the bond market that China could retaliate by dumping its holdings of US bonds. This was one of the key reasons for the yield to go up the week before last, although the exact reason for the tantrum is still being investigated.Top investment bankers have forecast a 50 per cent/60 per cent probability of a recession. In a globalised economic environment, this means a slowdown in global GDP. This combined with high US bond yields, used as benchmark to price risk assets across the globe, can be a double whammy for equity investors.Investors across the world, including in India, must keep an eye on the US bond market.Two, is the issue of the US government’s addiction to spending, which of course Trump is trying to address with DOGE. While the US fiscal deficit cooled to 5.5 per cent of GDP in 2022 (calendar year) after having skyrocketed to 15.7 per cent of GDP in 2020 due to Covid stimulus, the ratio has now inched back to 6.8 per cent. Even worse, interest outlay of the Federal Government for 2024 surpassed the national defence outlay for the first time in the nation’s history. This reminds of Ferguson’s law – ‘any great power that spends more on debt servicing than on defence, risks ceasing to be a great power’.Similarly, this debt pile of the US and high yields are not only a problem for the US, but one for equity investors across the globe. First, the policies that the Trump administration is trying to implement could result in a stagflation in the US, a period of recession driven by inflated prices.

First is the refinancing problem. The previous administration ducked the interest rate pressure by issuing short-term bills instead of long-term bonds. While the approach was unsustainable for long, it’s the current administration’s problem to now refinance them with long-term bonds and will add further pressure on yields.The third factor is one that is self-inflicted. The policy of the Trump administration, going back and forth, attempts to upend global supply chains and could tarnish the safe-haven status of US Treasury securities and the global reserve currency status of the dollar. This is where trade war blows up into capital wars. Although there is no strong alternative to the US dollar yet, global central banks might turn to other currencies or gold even more. A week ago, speculations were rife in the bond market that China could retaliate by dumping its holdings of US bonds. This was one of the key reasons for the yield to go up the week before last, although the exact reason for the tantrum is still being investigated.While the Trump administration is determined to bring yields on long-term bonds down, the Fed’s preference to wait and watch given tariff-led upside risks to inflation is playing a brick wall. Last week, Trump said he couldn’t wait to have Powell’s office terminated, while at the same time Powell’s chairmanship is legally well-guarded. The deadlock is a classic case of when an unstoppable force meets an immovable object.Decades earlier, Richard Nixon’s Treasury Secretary famously said: “the dollar is our currency, but it’s your problem”.

US debt, an equity woe

The week before last, US 10-year bonds witnessed the worst week since 2001, with yields spiking 50 basis points over the week to 4.5 per cent. Though yields cooled over the week gone by, a new drama surfaced with a brewing feud between President Trump and Fed Chair Powell.Today, the US’ debt to GDP stands at a significant 122 per cent (December 2024). Bond yields shooting up can burn a hole through the Federal Government’s finances, thus explaining Trump and his administration’s fixation on bond yields. In fact, it was the bond tantrum from the earlier week that pushed Trump to swiftly go slow on reciprocal tariffs.Similarly, this debt pile of the US and high yields are not only a problem for the US, but one for equity investors across the globe. First, the policies that the Trump administration is trying to implement could result in a stagflation in the US, a period of recession driven by inflated prices.Investors across the world, including in India, must keep an eye on the US bond market.Top investment bankers have forecast a 50 per cent/60 per cent probability of a recession. In a globalised economic environment, this means a slowdown in global GDP. This combined with high US bond yields, used as benchmark to price risk assets across the globe, can be a double whammy for equity investors.

-

india2 years ago

india2 years ago“Major Crash of Sukhoi Su-30 and Mirage 2000 Fighter Jets in Madhya Pradesh”

-

Sports2 years ago

Sports2 years agoWFI meetings on April 16, elections likely to be discussed

-

india1 year ago

india1 year agoPM Modi Meets Deve Gowda for Seat Sharing Talks

-

india1 year ago

india1 year agoBengaluru: False threat to bomb Raj Bhavan

-

india2 years ago

india2 years ago“AIMIM to Contest 50 Seats in Upcoming Telangana Assembly Elections”

-

Entertainment1 year ago

Entertainment1 year agoAnant Ambani: Controversy at the Ambani Pre-Wedding Bash

-

Karnataka2 years ago

Karnataka2 years agoWomen have to show their Aadhaar to travel free on KSRTC bus

-

Entertainment2 years ago

Entertainment2 years agoRajinikanth is Moideen Bhai in ‘Lal Salaam’